Crypto Scams: How To Identify And Avoid Them

Crypto scams are any fraudulent activity associated with cryptocurrencies. They are usually targeted at new crypto users, although more experienced people also fall victim.

The expansion of the Internet brought the expansion of crime online. So, while scams are nothing new, the World Wide Web creates new avenues for con artists to ply their trade.

Chainalysis reports, for instance, that illicit crypto transactions in 2021 reached $14 billion, which is equally a new record for online crime proceeds. The only problem with crypto is that you have limited means of recovering your loss.

It is left for you, therefore, to get to know the most popular crypto scams and to learn how to avoid them as well. This post helps you with that by listing the top methods out there.

Tips on Avoiding Crypto Scams

While different crypto scams require different solutions or approaches to avoid them, there are a few basic smarts that everyone should know to avoid falling victim to scams. Here is a quick list:

- You should never share your private keys or any code meant to be private with anyone. That is unless they have a gun to your head. Else, anyone requesting any information or code from you is probably a thief.

- Also do not send any crypto coins to anyone with promises of work, winnings, free money, or who claims to be from the government.

- Always check that you are connecting over https:// and not http:// for your security

- Always check that there are no spelling mistakes on the website address.

- Always enable multi-factor authentication for your accounts to help prevent theft.

- Run away from websites that have bad grammar, raise a red flag in any way, or that you just don’t like.

- Anytime you are about to make a crypto payment under pressure. Stop and consider if you might regret your actions later.

Most popular crypto scams

Here are the most common types of crypto scams on the internet:

1. Fake ICOs

The ICO or Initial Coin Offering is one of the newest concepts to hit the crypto and financial worlds. And it has minted many new millionaires and even billionaires. So, there is a good reason why everyone wants to get in on the action.

The problem, however, is that scammers are also aware of the desires of everyday people to become crypto millionaires, and that’s how it all starts.

A fake ICO scam will usually announce an upcoming ICO via social media and urge you to act as quickly as possible because it is the next big thing since Cardano. They may also state facts, but all their figures are usually nonsense and don’t hold water.

Spotting a fake ICO is simple; run a background check on the coin or ask a crypto expert.

2. Fake Apps & Websites

Some scammers pose as cryptocurrency exchanges that offer many enticing rewards. Others may offer to help you invest your coins for mouth-watering returns, or simply make you believe that you are using a reputable service.

Fake websites are also there to collect your login information, a method also known as phishing. Once you log into the fake website, the scammer has all your details and can use them to take over your account.

With exchanges and other services, the goal is to make you part with your funds as quickly as possible. Then once you do, it becomes too late.

To spot and avoid fake apps and websites, you need to keep an eye on the service’s name to make sure that it is not a fake copy of a genuine company. Also, do some research before signing up for any new service or downloading their app. The best measure, however, is to go with established brands.

3. Traditional Scams

These are like traditional Internet scams, but with a crypto twist to make it all new and interesting. They range from romance scams to marketplace, phishing, employment, and Ponzi schemes.

Here is a summary of each type:

- Romance – You are single, so you go online and meet a very interesting new lover. He makes lots of money from the financial markets and lives well. He will often talk about this new coin that is sure to make you both bazzilionares. Finally, he either offers to help you invest or you decide to give him your savings by yourself.

- Marketplace – Traditionally, you buy something on the Internet and get payment instructions. Only that the seller disappears after receiving your payment. It is the same with crypto scams, except that you pay with cryptocurrency.

- Employment – This one is another oldie. If you can read from A to Z and count from 1 to 20, then you are qualified for this new job that can make you up to $5 million every month. Just check out Andrew, he is even making more than that and living the Internet life. All you have to do is purchase “this pack” for $399 and you are on your way to becoming an Internet millionaire. Get it?

- Phishing – Here, the scammer tries to get your private information. For example, access to your wallet, your keys, and so on. Phishing can take different forms, from using fake websites to capture your information, to sending you bogus emails, through telephone calls, and any other means to get the info. This is a vast field and the science is called social engineering.

- Ponzi – Named after Italian conman Charles Ponzi, a Ponzi scheme lets you invest money in a supposedly lucrative business. But the problem is that there is no business. First, the scheme’s manager will use your investment to pay older investors and use the investments from newer investors to pay you. Of course, they will be living large from the proceeds all this while, but the scheme eventually crashes. So, always do your research first.

4. Pump & Dump

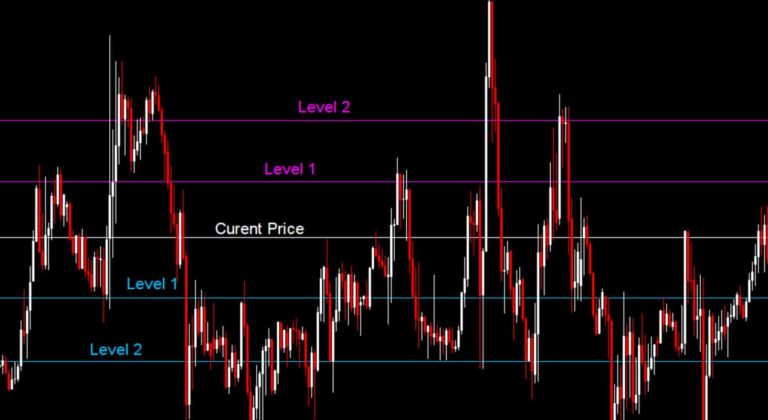

The Pump & Dump scam has its origins in the financial markets and is banned by many exchanges. Its mechanics are simple – a group of fraudulent speculators focus on a particular security and aggressively keep buying it over a period.

The result is a constant increase in that security’s price that other speculators notice and decide to join the ride. This is when the fraud happens, as the original speculators sell everything they were buying. In other words, they dump the securities on the new entrants.

Pump & Dump works the same way with cryptocurrencies. A bunch of crooks target a poorly-performing coin and slowly create a buying frenzy around it. And once a hopeful investor sees the coin on the ‘trending coins’ list, they automatically rush in to buy.

Avoiding Pump & Dump scams is straightforward; only make investments that you understand. If you do not know why a crypto coin rises, then you will also not know why it falls. So, always do your research.

5. The Rug Pull

A crypto rug pull is exactly like the name suggests – crypto developers suddenly abandon a project and disappear with investors’ funds. This scam happens frequently in decentralized exchanges or the DeFi (decentralized finance) ecosystem.

The major reason behind crypto rug pulls is that decentralized exchanges allow users to list tokens without a proper audit process. And the exit can occur either using a backdoor in the smart contract or by the developer quickly dumping his assets.

Crypto exchanges are either centralized like Binance and Coinbase, or they can be decentralized like Exodus. Each approach has its pros and cons. But for better regulation and to avoid scams like Rug Pulls, you are better off with a centralized exchange.

6. Malicious NFTs

This scam is based on hacking crypto platforms and has been recently executed on the OpenSea NFT system. OpenSea is the largest NFT marketplace, recording up to $3.5 billion in monthly trading volume.

One of its system vulnerabilities recently allowed scammers to buy the popular Bored Apes NFT for just 0.77 ether ($1,760), and quickly resell them for 84.2 ether ($192,000).

Another discovered system flaw would have even allowed an attacker to clean out a user’s wallet just by airdropping NFTs and getting the user to click on them.

7. Tokens You Cannot Resell

How about buying a crypto coin and later realizing that you cannot resell it? This scam also employs smart contracts. The scammer adds a clause in the code that you cannot resell the token.

So, the scam gang starts to buy their coins and its price starts to rise. You and many others may then notice this new emerging coin, so you buy some of it. The problem is that no one except the scammers can resell a coin once bought. So this makes its price keep going up.

Avoiding such a scam can be tricky if you are always on the lookout for new coins. The best way to avoid it is to stay away from newly launched cryptocurrencies. Another option is to buy a little at first and try reselling it to see how things go.

8. Celebrity Giveaway Scams

Celebrities often engage in giveaways on social media. But if the celebrity asks for a small deposit from you, so you can qualify for the free money they are giving away, then it is time to run.

This scam works like this: First, the scammers hack into a popular account. On Twitter, this might even be one of those accounts with blue verified badges. Secondly, they change the name and pictures on the account to reflect that of a well-known celebrity. Then, they launch the campaigns.

To identify such scams, always check the profile address of the celebrity to confirm with the original. Secondly, be smart – there is no need to first pay someone that wants to pay you.

9. Malware Scams

Malware includes all types of harmful applications that run on your computer or smartphone. The concept of malware crime is not new, but rather than targeting your credit card details, crypto-malware targets your crypto wallets.

Some will monitor your clipboard for crypto addresses, while others can be even more insidious. In the end, they will either steal your keys or exchange crypto payment addresses with that of the scammer.

Another method worth mentioning, although not purely a scam, is ransomware. These lock your device and demand a ransom payment in crypto coins.

Conclusion

We have come to the end of this post on identifying and avoiding crypto scams. And you have seen the different methods out there and the best approaches to avoiding becoming a victim.

It is important to note that investment success is highly unlikely without some risk. So, while your capital will always be at risk in one form or the other, you can at least get rid of the scams.