How to trade crypto futures

Crypto futures are just like other tradeable futures – you speculate on the future price of a cryptocurrency and buy a contract to make some profit off it.

You should note, however, that most crypto futures trading contracts are CFDs. That is, a Contract For Difference, which means the exchange will either pay your profits or deduct your losses, but no assets are bought or delivered.

Trading crypto futures can be worth your while, because there are many benefits like protecting your assets, growing their value, and even making big wins.

This post looks at how you can get into crypto futures trading. And this includes making use of the Binance platform, the world’s #1 for cryptocurrencies.

Intro to futures trading

Futures trading is a market participation model, where you bet against the future market price of an instrument by entering into a contract today.

It originated from the world of commodities trading, where traders bought the stock of agricultural products like cotton or rice before they came to market.

This process was originally in a bid to secure access to the commodities. But futures trading has evolved into a wider range of financial instruments, including stocks, currencies, precious metals, government bonds, and of course, cryptocurrencies.

Originally, futures contracts obligated the buyer to buy the commodity at the said price on a future date and the seller to sell said stock at the said price. But futures trading for most other instruments has evolved into a contract for difference basis.

Benefits of Futures Trading

Futures trading has many advantages. But the four major ones are lesser trading restrictions, the ability to hedge your funds, the ability to speculate both ways, and high leverage. Here is a closer look at these benefits.

- Lesser Restrictions – There are fewer restrictions on futures trading than you will find in exchange-regulated stocks or commodities, for example.

- Full Speculation – You can speculate both ways. That is, you can buy and make money from increasing prices. Or sell and make money from decreasing prices, no rules broken. This is unlike what you will find in many exchanges.

- Hedging – In addition to speculating both ways, you can also hedge your trades. That is, you can go long and short at the same time. This technique helps to maintain the value of assets against loss from market changes.

- High Leverage – Futures trading allows higher leverage than you will find with some other trading environments. Leverage amplifies the potential gains, and losses, of a trader’s efforts, making the endeavor much more exciting.

Futures vs Spot vs Options

Before moving on, you should note the three major methods of pricing trading instruments that originated from trading exchanges and older market environments. Although we are dealing with cryptocurrencies here, these same concepts also apply. So, here is a closer look:

- Spot – When you hear the ‘spot price’ of a trading instrument or contract, then the current price is being referred to. The spot is the trading price that you can pay at the moment and own the asset.

- Futures – Futures refer to the price of the commodity or instrument in the future. You are pledging today to pay a certain price in the future. This practice comes from the world of commodity trading, like corn, oil, and so on.

- Options – Option contracts are similar to futures contracts. But a buyer is obligated to pay a futures contract and the seller is obligated to honor the sale by a particular date. The seller or buyer of an options contract, however, retains the right to refuse to buy or sell.

Why The Binance Platform?

This step-by-step guide focuses on using the Binance platform, and for many good reasons. Here are the most important ones.

- Largest Exchange – Yes, Binance is currently the largest cryptocurrency exchange. And that means a lot, including trust.

- 90+ Instruments – There are so many instruments to choose from. So you will not be disappointed.

- Deep Liquidity – The platform is solid and dependable.

- Intuitive system – The trading station is well designed and easy to understand and use.

- Fast Executions – Binance boasts of latency as low as 5 milliseconds.

Important Terms To Note

There is a lot to learn in trading, but they are not all equally important. The following terms are worth noting, as they will make your trading experience better.

- Long or Going Long – Means buying the trading instrument. This is usually in expectation of a price increase.

- Short or Going Short – Also called shorting the market, means to sell the trading instrument.

- Money Management – Important steps every trader must take to avoid ruining a trading account unexpectedly.

- Position – Your view of the market or trade direction. A trader can take a long or short position.

- PnL or P&L – Your account’s stand at any given time. This metric takes the profit and losses into context, so you know exactly where you stand.

- Margin – An amount of money that your broker needs you to have in your trading account before you can open a position. It should usually be enough to cover any trading losses.

- Leverage – The funds that your broker lends you, so you can trade larger volumes. Leverage amplifies your trading profits or losses, and different platforms offer different leverage levels.

- Stop Loss – This is the maximum loss you can accept per trade. You calculate the number of points, then add it to the current price. So, if the market goes against you till that price, then the platform closes the trade to save your account.

Prerequisites to Trading The Markets

No matter if you are trading cryptocurrencies, Forex, crude oil, gold, or stocks, there are rules to live by, so you do not get burnt.

Therefore, if you want to succeed as a trader, then you first need to get the following prerequisites in place, before risking your funds in the open market.

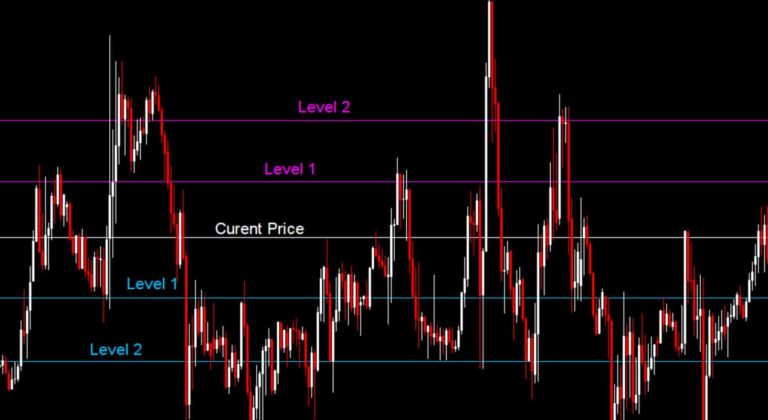

1. Develop a Strategy

Different markets may have different characteristics, but they all move up sometimes and move down at other times. The goal is to know when prices are about to rise, so you can buy. And to know when the same prices are about to crash, so you can sell.

How you achieve such a market insight is called a trading strategy and it is the single most important factor to trading success. A trading strategy helps you to analyze the market and determine the prevalent trend. This helps you to know when to enter the market with either a buy or sell order, and when to exit.

There are many strategies out there. And every man has to find what best suits him. Some focus on longer-term trades, while others focus on the short-term. Some use moving averages, while others include channels, divergence indicators, breakout strategies, or simple trend-following methods.

Your first step is to understand your personality, so you can choose between the long and short terms. And then find a strategy that suits you.

2. Understand Risk & Money Management

The best trading strategy is still useless without proper money management. Trading is a risky business and you need to understand this fact and work with it to survive.

Your goal is to minimize your risk per trade, so you can still last a few trades if you theoretically kept losing. A good piece of advice is to only risk a maximum of 2-5% of your trading capital with any single trade. Another good piece of advice is to cut your losses short and let your profits run.

In practice, this means that you will set a certain number of points that once the market goes against you beyond that point, the trade is considered a loss. This number of points usually depends on your trading strategy and how short- or long-term it is.

Secondly, you will then calculate these numbers with your account balance. So, those maximum loss points should be no more than 2-5% of your account balance. This is how you cut your losses short.

3. Keep Learning

Although you have learned the two most important trading lessons above, you still need to continue learning. Life is a continuous learning process and the more you learn, the better you become.

How To Trade Crypto Futures

The following is a simple step-by-step guide to setting up an account and trading futures contracts on the Binance platform in no time.

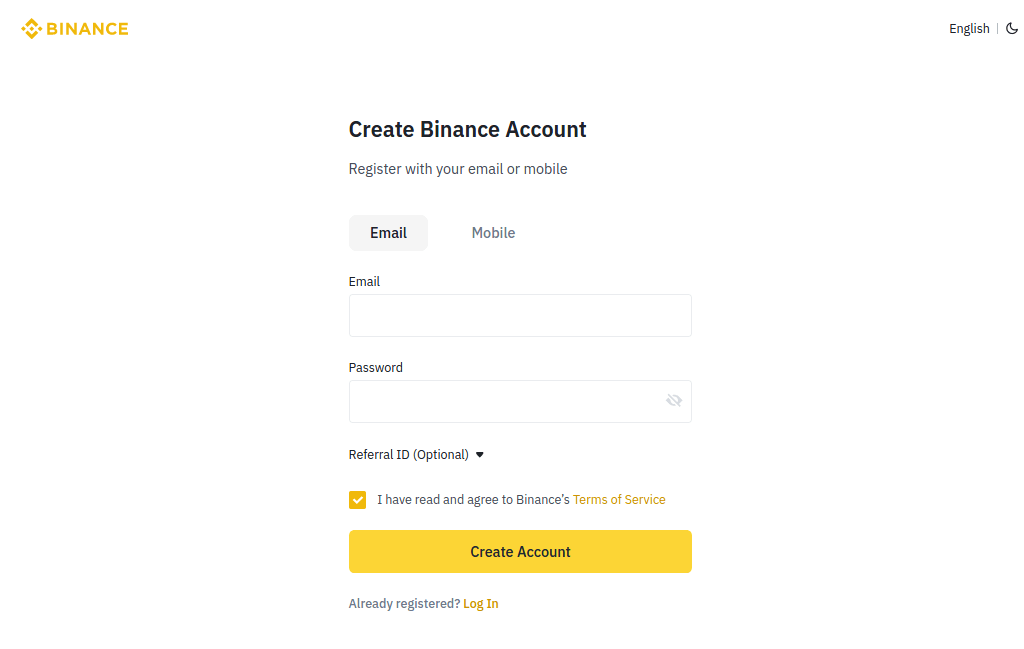

Step 1: Open a trading account.

Open a Binance account and activate it, if you haven’t already.

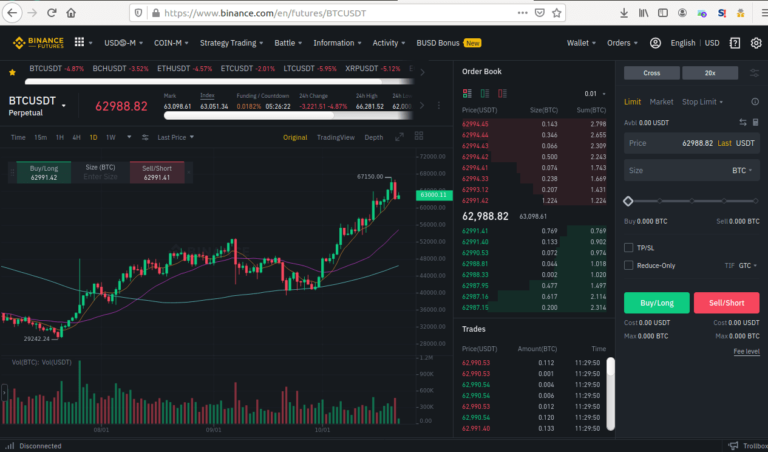

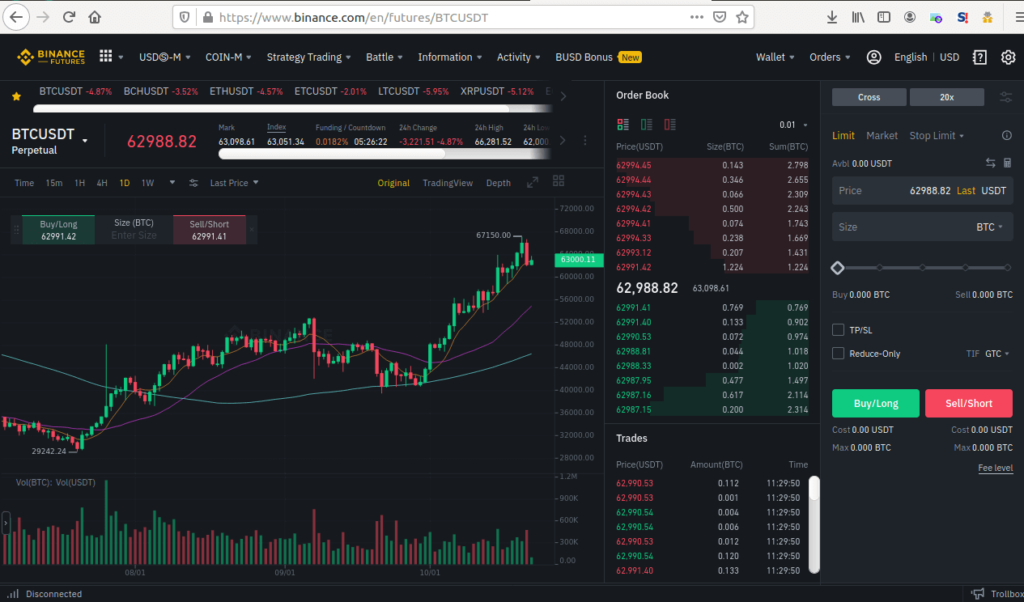

Step 2: Login & select contract type.

There are 2 types of crypto-futures contracts on the Binance platform. They are the USD-M contracts settled in USDT or BUSD and the COIN-M contracts settled in other cryptocurrencies. You will also need to choose between delivery contracts that have a specific end date and perpetual contracts that do not. You can make your choice at the Binance future platform.

Step 3: Open a future account

On the trading interface, click on Open Futures Account. Binance will first offer you a quiz that you have to pass before trading.

Step 4: Fund account

Fund the futures account. You will either need to directly transfer funds into this account or borrow some crypto assets to fund it. This account is a separate wallet that is used solely for trading.

Step 5: Select instrument

Once your futures trading account is funded, get back to the trading platform. Then select your instrument of choice from the top left menu.

Step 6: Adjust leverage

Binance lets you adjust the leverage of individual contracts. To do this, go to the order entry field, click on the current leverage, and adjust as desired.

Step 7: Place your order

Place your order by clicking on Buy/Long or Sell/Short to start trading.

Conclusion

We have come to the end of this crypto futures trading guide. And you can see that there is quite a few stuff to learn before becoming a competent and successful trader.

The Binance platform itself is extensive, so you will need some time to get used to it. You can also test it on Binance Test net without an account and if you need more help, just check out the Binance Academy.