Ponzi schemes: How to identify and avoid

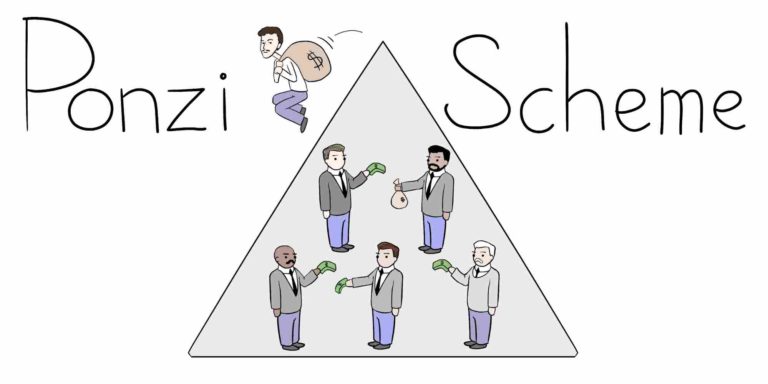

Ponzi schemes are everywhere, so how do you identify and avoid them? A Ponzi scheme is an investment fraud designed to scam those looking for easy and guaranteed earnings.

60 schemes got busted in 2019 which raised $3.2 billion from victims. In 2020, it was 46 schemes that raised over $1 billion. And in 2021, 34 schemes raised $3.8 billion.

Ponzi schemes earned $98 million on average from 2008 to 2013. But most schemes raise $10 million or less, while a few raise over $100 million.

This guide shows you how Ponzi schemes work. So you can easily identify and avoid them.

What Is A Ponzi Scheme?

A Ponzi scheme is a type of investment fraud that uses investment deposits from new members to pay interest to older members and manage the organization’s expenses without actually having a product. The Ponzi organizer typically lures potential investors with claims of easy and safe investments, while the older members testify to the progress of the business because they are getting paid.

The name comes from Italian businessman Charles Ponzi, who successfully defrauded many victims in the 1920s and eventually gained lots of fame for his crimes.

A typical Ponzi scheme will advertise one business or the other and invite you to become an investor with enticing and guaranteed regular payouts. Unfortunately, people you know or trust, may already be part of the system and confirm that they are getting paid regularly.

If they convince you and you invest in the scheme, then these older members get paid from part of your deposit, while the rest of the funds go to the scheme’s founders. These friends or celebrities that you know, will, however, believe that they are making legitimate profits and this helps to perpetrate the fraud.

Most Ponzi schemes will also entice members to bring in new members or investors. These types are called pyramid schemes and with them, you also get part of the deposits from each new member that registers under you as commissions. And sometimes even from those that register under them.

The problem with Ponzi or Pyramid schemes is that the underlying business does not create value in any way – no real services are offered or products sold. So, somewhere down the line, the inflow of new investor capital will dry up and the scheme will eventually collapse.

How To Recognize Ponzi Schemes

There are different styles of Ponzi schemes out there, so there is no single method of identifying them. However, the following points can help you to identify potential Ponzi scams:

- High Returns in A Short Period – If the promoter is promising high returns in a relatively short period, then that’s a red flag. Of course, some legit businesses can deliver such returns, but it’s still a red flag.

- No Genuine Product or Service – This is what sets Ponzi and Pyramid schemes apart from all other types of scams. Ponzi businesses do not have genuine products or services from which they make most of their money. If any business proposal lacks a product or service that makes money from customers, then it’s most probably a Ponzi scam.

- Emphasis On Recruiting New Participants – Many legit MLM companies do this and it’s okay when the company has a profitable product or service. But when a company lacks a profitable product or service but places more emphasis on recruiting new members, then that’s a big red flag.

- Promoter’s Overt Wealth Display – Most rich people live normal lives. So, when a promoter keeps focusing on living a rich life, then it is often just to get you to part with your money.

- Unregistered & Unregulated – Never invest in a company that is neither duly registered in a respectable jurisdiction nor licensed by a competent financial regulator.

- Shady, complex, or secretive – If you sense so much going on in the background that you do not understand, then maybe you should forget the investment.

- Difficulty Cashing Out – Your money is your money and you should have access to it anytime you want. So, if you see any program with complex rules that limit you from withdrawing your investment at your convenience, then that’s a red flag.

- Affiliation With Previous Schemes – If you run a little background check on the investment’s founders and you find that they’ve been part of a previous Ponzi scheme, then it is highly likely that the current business is also a fraud.

- Regulator Warnings – If a financial regulator has issued a warning about the company or a similar company, then it is probably a Ponzi scheme.

- Listen To Your Guts – If something seems off, pay closer attention to the business proposal, ask questions, and do more research.

Ponzi Schemes vs Multi-Level Marketing

Ponzi schemes are often confused with Pyramid schemes and MLM (Multi-Level Marketing) systems, so a little explanation might be necessary here.

First, a Ponzi scheme just needs to make money from unsuspecting investors. The victim is unaware that the business is a fraud because it keeps paying a certain percentage to previous investors.

A pyramid scheme, on the other hand, is a Multi-Level Marketing company without a product. You should note that there are tons of legit MLM companies that consistently make profits from legit products out there.

An MLM simply pays each member that recruits a new member a higher commission. This entices members to recruit new members and thereby spread the network. And so long as their product is great, everybody wins.

A pyramid scheme functions the same way as an MLM. But similar to Ponzi schemes, the pyramid scheme has no product to sell and is, therefore, a fraud.

How To Avoid Ponzi Schemes

Ponzi schemes are everywhere and the schemers are always on the lookout for fresh victims. Of course, every business venture comes with risks, and this is understandable. But it is your job as an investor to make sure you are putting your capital in the right hands.

The following are issues and steps you should consider before engaging in any business:

- Only invest in what you understand. Avoid business proposals that you can’t figure out.

- Do not be greedy.

- Check out the promoter and company. Always run background checks.

- Be wary of unsolicited offers.

- Make sure the company is registered and regulated. This helps to weed out most scams.

- Be wary of low-risk investments.

- Consult a financial expert before committing to any investment.

Smart Ponzi Schemes

In addition to simply looking fur gullible investors, smart Ponzi schemes often leverage the hype surrounding new technologies to make them seem like modern and complex businesses with bright futures.

Some of these technologies include cryptocurrencies, the Blockchain, smart contracts, the Forex industry, stocks, and so on. What they all have in common with other Ponzi schemes, however, is that their founders are not engaged in the businesses they claim to be engaged in.

Notable Smart-Ponzi schemes include Onecoin, Bitconnect, PlusToken, and Mining Max. You will also find systems such as Terra LUNA with hocus-pocus algorithms that sound so smart that everyone wants to invest in them – until they crash and burn.

Notable Ponzi Schemes & Schemers

There are so many Ponzi schemes and schemers out there, but some are larger than others. Here are the most popular ones:

- Charles Ponzi – The man that this crime is named after. He died poor and broke.

- Bernie Madoff – Took in an estimated $62 billion. Sentenced to 150 years and died in prison.

- Onecoin – Cryptocurrency Ponzi Scheme. Its founder, Ruja Ignatova is still on the run.

- Zeek Rewards – Internet Ponzi scheme.

- MMM – Massive Ponzi scheme with millions of victims.

FAQs

Q: I think I have fallen victim to a Ponzi scheme, what do I do?

A: First report to the bank and block any further funds to the fraudsters. Next report to the relevant authorities. (See the resources section below)

Q: Can I get my money back from a Ponzi scheme?

A: It depends. If the scam is still running, then maybe you can. But proceed with caution and alert the authorities where necessary. If the scammer has already disappeared, then it’s less probable.

Q: Are all cryptocurrencies Ponzi schemes?

A: Not all cryptocurrencies are a Ponzi scheme or started as such. However, market forces change people and money can be very tempting. So, it is necessary to regulate the cryptocurrency industry, or else Ponzi schemes and other scams will continue.

Q: How long do Ponzi schemes last?

A: A Ponzi scheme can last for many years, and this often gives them the impression of being legit. While Bernie Madoff’s scam lasted for 17 years, the average lifespan of a Ponzi scheme is 4.3 years, with the schemer earning roughly 30% of all proceeds. –source

Q: Are High Yield Investment Programs also Ponzi schemes?

A: Yes. At least 99% of HYIP (High Yield Investment Programs) are Ponzi schemes.

Resources

https://en.m.wikipedia.org/wiki/List_of_Ponzi_schemes

https://www.investor.gov/protect-your-investments/fraud/types-fraud/ponzi-scheme

https://adviserinfo.sec.gov/IAPD/Default.aspx

https://www.sec.gov/edgar.shtml

Online High Yield Investment Programs

- https://reviewparking.com/top-hyip/

- https://hyip-zanoza.me/vote-hyips

- https://bitmoneytalk.com/top-hyip/

Conclusion

If you come across any moneymaking opportunity that promises easy earnings or amazing, consistent returns on your investment, then it is most probably a scam.

Remember, if it’s too good to be true, then it probably is.