How to invest & make profits from dual investment in easy steps

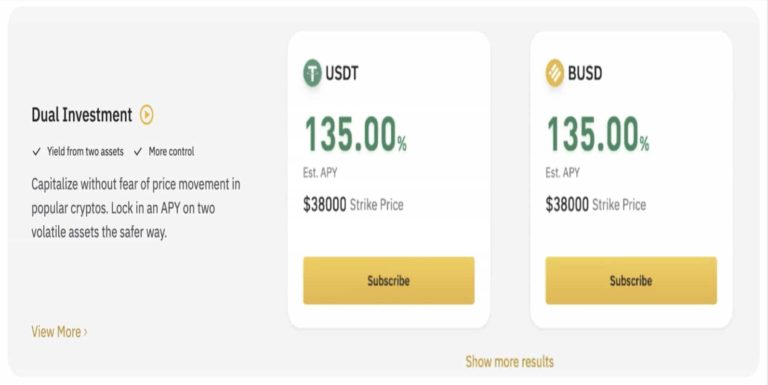

The Dual Investment option from Binance helps to maximize your earnings from crypto holdings without much work. Here is everything you need to know about it.

Cryptocurrencies can be volatile. So, if you are looking to maximize profits from your crypto assets, then a dual investment approach might be for you.

Binance, the world’s largest cryptocurrency platform, offers you the ability to earn more from your crypto coins through dual investment. A simple, but smart investment approach.

This guide shows you how to make the most of your crypto assets using the Dual Investment vehicle. All you need is a little time to grasp the idea, and you are good to go.

The Benefits of Dual Investment

Cryptocurrencies can be volatile – their prices fluctuate widely. So, holding your assets in a particular crypto coin comes with both the risk of value depreciation over time and possible appreciation over the same period as well.

A dual investment is a financial product that allows you to profit from these price swings by making it easier to earn higher yields on your capital.

The Binance Dual Investment product, specifically, first allows you to earn a guaranteed interest on any fixed deposit that you make. Then, it additionally includes a currency option instrument to help maximize your profits in favorable market conditions.

The Benefits of the Dual Investment Derivative:

- Earn guaranteed interest on your deposit.

- Earn extra yield in favorable market conditions.

This combination of a cryptocurrency deposit and the ability to switch to a different currency with a binary option allows any investor to maximize earnings from crypto holdings with little or no stress.

It is a helpful financial product for seasoned investors who want to maintain cryptocurrency assets. And for beginners and investors with limited time and who want to extract the most value from the cryptocurrency markets.

How Binance Dual Investment Works

The Binance Dual Investment product is a derivative that combines a fixed cryptocurrency deposit and a binary currency option. The fixed-deposit part guarantees a fixed interest (yield) on the principal that you invest. While the binary currency option enables extra earnings.

Here is a quick look at both instruments:

- Fixed Cryptocurrency Deposit – You deposit your crypto assets for a fixed period and at a fixed rate. The fixed-deposit period can range from 15 days to 30 days, and so on. And at the end of this period, Binance will credit your account with the yield.

This interest rate is usually dynamic and changes with market conditions. But once you subscribe to the product, the rate becomes fixed. This way, you know exactly how much you are expecting after the fixed deposit period. - Currency Binary Option – A currency option offers the ability to exchange one currency for another. More traditional dual investment products allow you to deposit funds in currency A, for instance. Then give you the option of cashing your deposit in currency B. The goal here is either to offset any depreciation of currency A or to gain extra interest from the appreciation of currency B.

The rules about whether this exchange happens or not can be complex though, as it all depends on the financial institution. That is a traditional currency option, and there are other types as well. A binary option, on the other hand, sets out these rules in very clear terms. So clear and simple that it is binary – that is, either yes or no. Happened or didn’t happen.

In a buy situation, the currency’s price should be either above a previously set price level, or the option is not exercised. And in a sell situation, the currency’s price should be either below a previously set price level, or the option is also not exercised. The option here can mean any previously arranged transaction, such as a currency swap from one coin to another.

While traders call the buy and sell situations above call and put options, the Binance platform calls them Up-and-Exercised and Down-and-Exercised. These Binance terms sound more descriptive of what they do.

Here is a closer look at these two products offered by the Binance Dual Investment platform, as well as some other terms for elucidation:

- Up-and-Exercised – The contract here is exercised if the settlement price of the underlying currency is above the strike price on the delivery date. The potential earning is given in APY.

- Down-and-Exercised – The contract here is exercised if the settlement price of the underlying currency is below the strike price on the delivery date. The potential earning is given in APY.

- Exercised – This is the process of executing the contract. In this case, converting the principal and yield from the deposit currency to the alternate currency.

- Strike Price – A previously set price level that the settlement price must be above on the delivery date for the Up-and-Exercised contract to execute. Inversely, the settlement price must also be below the strike price on the delivery date, for a Down-and-Exercised contract to execute. All exercised contracts are calculated at their strike price.

- Principal – The exact capital that you invested.

- Yield – The earnings on your investment, calculated in percentage interest.

- Delivery Date – The final day of your fixed deposit.

- Settlement Price – Average market price of the underlying currency, 30 minutes before 8 AM (UTC) on the delivery date.

- APY – Stands for Annual Percentage Yield. And refers to the percentage you would earn if you locked your crypto coins in the Dual Investment product for one year. Binance Dual Investment APY values can range from single-digit percentages to well over 100%.

- Underlying / Deposit Currency – This is the cryptocurrency you are investing with.

- Alternate Currency – This is the cryptocurrency that you will get paid in if the market favors your Dual Investment contract and the option gets executed.

Some Example Investments

To gain a better understanding of how the Binance Dual Investment system works, here are a few examples. The first two are Up-and-Exercised contracts, while the third is a Down-and-Exercised one.

Example 1.

| 1. | Contract | BTC[Up-and-Exercised] |

| 2. | Current Spot Price | $35,573 |

| 3. | Strike Price | $38,000 |

| 4. | APY | 39.57% |

| 5. | Delivery Date | 2022-01-30 |

| 6. | Settlement Price | $38,970 |

If you made this investment in Example 1, then you would get paid in stablecoin at 1 BTC = $38,000 plus interest at 39.57% per annum. If you invested 1 BTC for 2 weeks above, then you should expect BUSD 38,568 in return.

Example 2.

| 1. | Contract | BTC[Up-and-Exercised] |

| 2. | Current Spot Price | $35,573 |

| 3. | Strike Price | $40,000 |

| 4. | APY | 17.02% |

| 5. | Delivery Date | 2022-01-30 |

| 6. | Settlement Price | $38,971 |

If you made this investment in Example 2, then you would only get the 17% p.a. rate because the option will not get exercised. So, if you invested 1 BTC for 2 weeks above, then you will receive 1.01533 BTC in return.

Example 3.

| 1. | Contract | USDT[Down-and-Exercised] |

| 2. | Current Spot Price | $35,573 |

| 3. | Strike Price | $34,000 |

| 4. | APY | 33.3% |

| 5. | Delivery Date | 2022-01-30 |

| 6. | Settlement Price | $33,970 |

If you made this investment in Example 3, then you would get paid in BTC at 1 BTC = $34,000. For a 20,000 BUSD investment for one month at the rates above, you would receive 0.60433521 BTC.

How to Make Profits with Binance Dual Investment

Investing and earning with Binance Dual Investment is easy once you know the basics and how everything else works. All you have to do is follow this simple step by step guide below:

Step 1. First, head over to https://www.binance.com/en/dual to begin.

Step 2. Log in or register if you do not already have a Binance account. You may also be required to verify your identity.

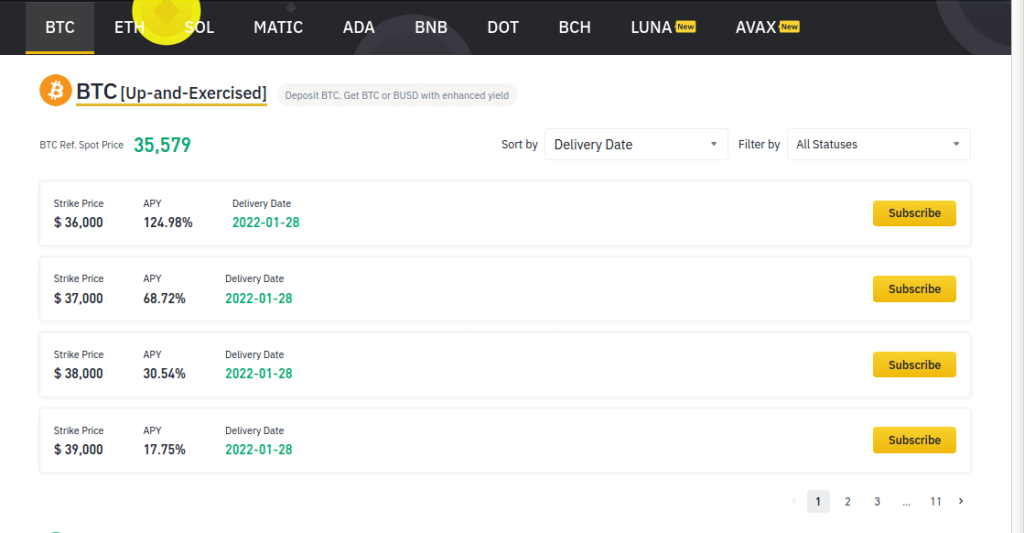

Step 3. Browse the Dual Investment page to see which contracts are on offer. They clearly state their strike price, APY, and delivery date. Plus a “Subscribe” button.

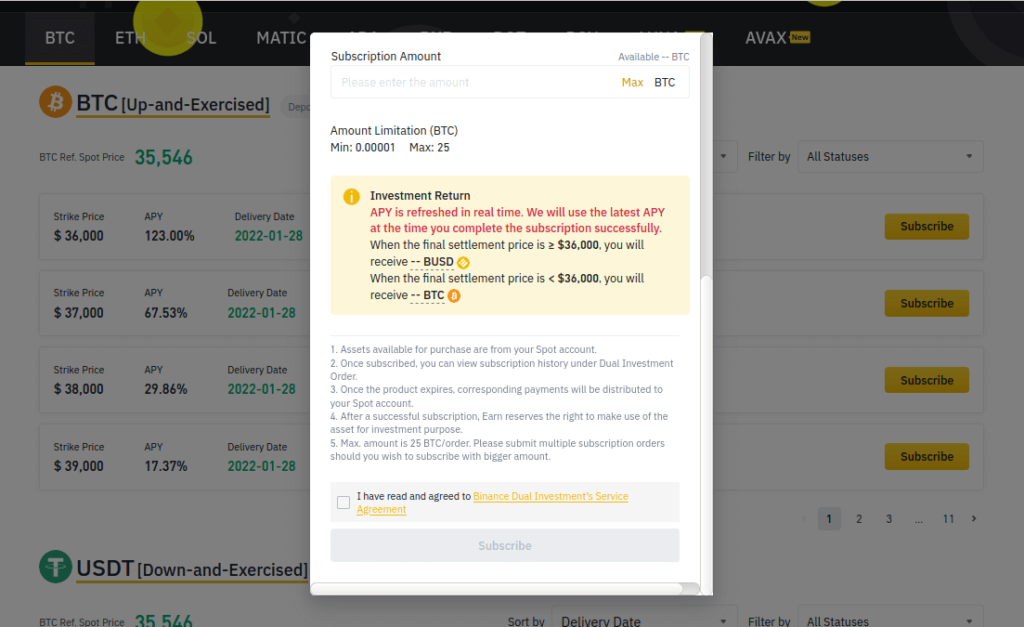

Step 4. Once you find an investment that you like, click on this Subscribe button. And you will see more details regarding the contract.

Step 5. If you like the investment’s terms and your account is sufficiently funded, then enter your subscription amount and click the checkbox to accept the service agreement.

Step 6. Finally, check the APY, delivery date, and strike price one more time. And if you are okay with it all, click on the “Subscribe” button.

That’s it! All you have to do now is wait for the contract to mature. You can also monitor things from your account page. Just click on “Dual Investment” under “Earn”.

How to Improve Your Odds & Maximize Profits

Gambling, speculation, and investing all involve taking risks with an uncertain outcome. However, gambling is based solely on luck or random choice, while speculation and investing depend on skills.

Improving your skills and increasing your understanding of the markets will help to increase the odds in your favor. This is because you are no more investing on impulse. Rather, your decisions become based on factual information. And you simply win more.

There are two ways to do this. The first is with fundamental analysis, which means paying more attention to financial news that affects your assets. You just want to know if political or economic decisions will have any impact on the asset’s price. And if it does, in what direction it will likely send the price.

The second way is with technical analysis. And as the name suggests, you use so-called technical indicators here to measure the price movements on a chart, then decide on potential price movement. The simplest and most under-rated technical indicator is the trend-line. Although many new investors overlook it, seasoned professionals and institutional investors swear by it.

The Risks of Dual investment

Of course, there is risk in everything that we do. And this includes investing in general and this Binance Dual Investment program. However, the risk here is minimal and your capital is not at risk as with many other high-risk schemes.

Still, it is important to understand exactly what you are facing, should you choose to give Dual Investment a try. So, the following are the associated risks:

- You cannot cancel a subscription – Once you subscribe to a package, then there is nothing else you can do. You cannot cancel or change it in any way. Your holdings are illiquid and you must wait till the contract matures to regain possession.

- The principal is not guaranteed – While the yield is fixed and there is no high risk of your principal disappearing, the same cannot be said of maintaining the principal’s value once the contract is exercised, as you are getting a different currency. The reason is that you will first have to convert the alternate coins back to the deposit currency to truly book your profits. And depending on when and how this happens, it remains theoretically possible that the re-converted principal will be lower than the original one. Even with the yield included.

- Holding Issues – When the markets move in your favor and your option executes, you should keep in mind that it’s the alternate currency that you receive that lost its value. In other words, it might have been more financially prudent to hold on to the underlying currency at this time. However, if you don’t mind holding the alternate currency or have plans for its immediate use, then there’s no problem.

FAQs – Frequently Asked Questions

What are the requirements for participating in the Binance Dual Investment offer?

You need to be a registered Binance user and have enough cryptocurrency in your account to participate. It will also be helpful to have a healthy understanding of market dynamics and forecasting methods.

How is the strike price calculated?

The strike price is fixed by the platform and it remains fixed from the time you subscribe until the contract matures.

How is the APY calculated?

It is initially dynamic as a result of market forces. But once you select a product that you like and subscribe to it, then that APY remains fixed until the contract matures.

When do I get paid?

Binance will credit your spot account within 24 hours after the Delivery Date.

What are the available Instruments?

The platform currently supports 10 cryptocurrencies. They include BTC, ETH, MATIC, ADA, BNB, DOT, BCH, LUNA, and AVAX.

Conclusion

As you have seen, the Binance Dual Investment package enables you to earn passive income from your crypto assets, no matter the market’s direction.

But while this system is an easy investment vehicle, it is still up to you to decide if it is right for you. And when it is, you can start here.