10 Best budgeting apps in 2025 for Android & iOS (Free and paid)

Looking for the best app to help you manage your finances? Take a look at the industries' top 10 budgeting apps here.

Budgeting apps help you in achieving financial freedom by providing the tools and methods that empower you to take control of your money.

A budgeting app helps you to rein in your spending, pay off your debts, and get your finances and future under control.

There are many ways to achieve this, using many tools out there. They can also employ different methods.

This list helps you out by providing a crisp view of only the top apps, so you can easily narrow things down to your best choice without a single doubt.

Top 10 Budgeting Apps

| Name | Best For | Price | Website |

|---|---|---|---|

| You Need a Budget (YNAB) | Overall best | $84/year | youneedabudget.com |

| Everydollar | Zero-based | Freemium | everydollar.com |

| Wally | Multi currency | Free, $25/year | wally.me |

| Mint | Customization | Free | mint.com |

| Monefy | Freeware | Free | monefy.me |

| Simplifi | Design | $35.88/year | simplifimoney.com |

| Mvelopes | Envelope | $6-19/month | mvelopes.com |

| Zeta | Couples | Free | askzeta.com/money-manager |

| Good Budget | Good Budget | Freemium | goodbudget.com |

| AndroMoney | Free | Freemium | web.andromoney.com |

1. You Need a Budget (YNAB)

You Need a Budget, also popularly referred to as YNAB, is a zero-based budgeting system, designed to pull you out of debt and get your finances in order quickly.

YNAB works by making every dollar count. Every dollar must have a purpose, a job. You create your budget based on your income, so you know exactly what to spend your money on.

YNAB works with four rules:

- Give every dollar a job

- Break down large payments

- Adjust your budget when you overspend

- Be purposeful in your spending

The app connects to your bank accounts and offers a high level of security, so there is nothing to worry about. The only issue is that it is not free.

YNAB costs $84 a year, but average first-time users save over $6,000 in their first year. So, it is still a good deal.

Pros: Award-winning app, very popular, 34-day free trial,

Cons: It’s not a free app

Website: www.youneedabudget.com

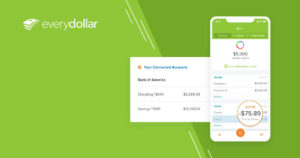

2. Everydollar

Also based on the zero-sum-budget, Everydollar is another popular budgeting app. It comes in a free version with limited features and a premium Ramsey+ membership.

The free version lets you input transactions manually into the app to help in managing your budget, while the premium version automates most of the work for you.

Every new user gets a 15-day free trial of Ramsey+, so you will know if you want it. There is bank syncing, automated bank transactions, custom reports, and lots of training classes to improve your budgeting skills.

Everydollar helps you to give every dollar a job by learning and practicing its 7 Baby Steps method.

Pros: Free app, premium features available

Cons: Ramsey+ costs $130 per year

Website: www.everydollar.com

3. Wally

If you use lots of bank accounts that you need to monitor with your budgeting, then Wally might be for you.

This app integrates with up to 15,000 banks in 70 countries and over 200 currencies beautifully. You can even sync and track joint accounts, so you can budget with friends and family to reach goals together.

Wally lets you break down your budget into categories, such as clothing, transport, entertainment, and so on. Then you can track all your different spending with real-time updates and a simple overview.

Pros: Sync multiple accounts, multiple currencies, a free version

Cons: Only available for iOS

Platforms: iOS

Website: www.wally.me

4. Mint

Coming from Intuit Inc., the makers of TurboTax and QuickBooks, Mint is a free budgeting app with lots of helpful features.

You get budget categorization to help you keep your spending in check. Then, there is a payment tracker to help track your bills, prevent late fees, and track your cash flow with ease.

Mint even offers you a fast and free credit report, so you will know where you stand with your finances.

Further features include investments and portfolio tracking, to help you keep an eye on your brokerage accounts, mutual funds, and other investment vehicles.

Pros: Automated syncing, free app, top quality

Cons: No international support

Website: https://mint.intuit.com

5. Monefy

Monefy is a completely free budgeting app designed for Android and iOS devices. It is also simple and easy to use, so it is easy to start working with.

It selects the default categories for you, so you can get on with it. Adding your expenses is also easy and painless, plus there is multi-currency support and a built-in calculator.

Monefy also lets you synchronize your budgeting with a partner using Google Drive or a Dropbox account and all record changes will automatically sync between the devices, for free.

Pros: Free app, easy to use, synchronize with partner

Cons: No automation

Website: https://monefy.me

6. Simplifi

The Simplifi budgeting app comes from Quicken, a company with a 3-decade history in money management. You can even see this experience in the app’s design.

There is a simple overview that lets you see the big picture at a glance, letting you know what is going on with your money at any time. This includes your bank balances, spending, loans, credit card, and investments.

You can also achieve your savings goals by saving like a pro with Simplifi. Just set up a goal and earmark steady contributions to stay on track.

Simplifi is available as a web app and as a mobile app for both Android and iOS devices. It has no free plan, but there is a 30-day free trial and $2.99 per month afterward if you pay annually.

Pros: Clear interface, simple design, bank syncing

Cons: No free plan

Website: www.simplifimoney.com

7. Mvelopes

As the name suggests, Mvelopes is an envelope-style budgeting system that uses categories to simulate the ancient method of envelope budgeting.

This keeps things simple and easy to understand. It also comes with learning resources, so you can deepen your knowledge of personal finance management.

There is no free plan with this app. However, it comes with a free-trial period, after which you can decide to continue using it or not.

Pros: Free 30-day trial,

Cons: No free plan.

Website: www.mvelopes.com

8. Zeta Money Manager

Managing money can be difficult for couples, but the Zeta Money Manager tries to make it easier by tracking all your combined accounts in one place.

Simply add all your accounts to the app, invite your partner to join, and then keep tabs on your money, optimizing for your future goals together.

Zeta also offers custom categories and lets you split transactions easily, by managing how you pay each other back. You can use personal or shared budgets, use and track custom categories, and set personal or shared goals with your partner.

Best of all, Zeta is completely free. Your information is encrypted and completely secure. Plus, its Memos & Messages features let you start that all-important money talk with your significant other.

Pros: Great for couples, share expenses, plan together

Cons: No international support

Website: www.askzeta.com/money-manager

9. Good Budget

Good budget is another envelope budgeting app that lets you “spend, save, and give towards what’s important in life”, in their own words.

But instead of carrying envelopes around, you get digital envelopes. They help you to visualize your spending habit to discover where to save money.

You can also share and sync the data between mobile devices and the web platform. So, you and your spouse can stay on the same page about your spending at all times.

Good Budget is available on the web and as mobile apps for iPhone and Android devices. It is also available in a free version with 1-year history and 10 envelopes and as a paid version for $60 annually, with unlimited envelopes, accounts, 5-device tracking, and up to 7-year history records.

Pros: Easy to use, syncs between phones

Cons: No automation

Website: https://goodbudget.com

10. AndroMoney

Enjoying a high 4.7 Play-store rating from over 250,000 users and over 1 million installs, AndroMoney is another budgeting app worth considering.

It is available for both Android and iPhone platforms, as well as on the web. This makes it a versatile tool for personal finance management.

AndroMoney offers good data security, multiple currencies, category budgeting, statistic reports including charts, and daily expense tracking with over-budget alerts.

AndroMoney is also free and if you like it, you can always go for the PRO version that costs only $1.99.

Pros: Tried and tested, free version, easy to use

Cons: Could look better

Website: https://web.andromoney.com

Conclusion

We have reached the end of this top 10 budgeting apps list, showing you all the different apps out there that make it easier to get your finances under control.