How to get & use Binance crypto loans

Considering getting a crypto loan but not sure how to proceed? Here is a simple guide to getting it done on the Binance platform.

Crypto loans are security-based loans that offer immediate access to capital in any cryptocurrency of choice. And Binance Loans is the market leader in this field.

People seek out crypto loans for many reasons. But they all involve the borrower offering collateral in exchange for the cryptocurrency that he or she wants to receive. This collateral is usually a different cryptocurrency.

Binance is the world’s largest and leading global platform for everything related to cryptocurrencies; from mining to conversions, trading, NFTs, and so on. So, this post looks at how to get crypto loans on the Binance platform and what you can do with the borrowed funds.

The benefits of crypto loans

A crypto loan is a cryptocurrency loan. And unlike standard fiat-money loans, crypto loans require a cryptocurrency as collateral to borrow another cryptocurrency. This means that you must own some cryptocurrency to qualify for a crypto loan.

The process is simple. You can borrow any amount of a cryptocurrency, so long as you have crypto assets that are worth more than the amount you are borrowing. Credit scores are not necessary here, since your crypto assets function as security for the loan amount.

This makes crypto loans ideal for the under-banked and for self-employed professionals or business owners, who would otherwise have problems accessing loans. Secondly, by avoiding the cash-out of your crypto assets, you are also avoiding taxable events.

Crypto loans generally have shorter loan terms than standard loans. And they can range from as little as 7 days, up to 6 months. Interest rates are, however, generally lower than you would get from credit cards. And unlike standard loans, crypto loans generally collect interests hourly or daily.

Processing times are also much shorter for crypto loans. All you need is to have the minimum required collateral in your wallet and the processing can be nearly instantaneous. The collateral gets frozen and the requested loan is released to you.

The advantages of using Binance loans

There are many good reasons to get your crypto loans from the Binance platform. Here is a list of the top ones and what they mean for you.

- Fair & Attractive Loan Terms – Binance Loans offers you the desired cryptocurrency based on the value of your crypto assets. These values are dynamic, as the platform monitors your assets and alerts you if their value is about to fall below a minimum required threshold. Only in extreme cases will Binance automatically liquidate your collateral to pay back the loan and refund the remaining funds to you .

- Low Rates – Another advantage of dealing on the Binance platform is the overall low-interest rates. You can expect rates of 1-2% for a majority of the loan transactions including Bitcoin and stablecoins like BUSD.

- Largest Crypto Platform – Unless you are new to the cryptocurrency world, you should know that Binance is the largest platform on the planet. And this comes with many advantages, such as better liquidity, more trading partners, and an overall more established platform.

- Security – Crypto exchanges can be DeFi or CeFi. CeFi stands for centralized finance, while DeFi stands for decentralized finance. Though decentralized finance platforms like Bitcoin offer many perks, there is little to protect you from malicious actors. A centralized finance platform like Binance, however, employs KYC (Know Your Customer) and AML (Anti Money Laundering) measures to guarantee a safer environment for even the least tech-savvy users.

- Extensive Platform Features – Binance is a large platform with extensive features. You can trade, borrow, buy coins, sell coins, deal in non-fungible tokens, lend out cryptocurrencies, and so on.

- Loan History Feature – The platform includes a loan-history feature that lets you check your previous loans, repayment, and liquidation histories.

Binance Loans vs Binance Margin

Before moving forward, you should keep in mind that there is a difference between Binance Loans and Binance Margin. These are two services offered by the crypto giant, but they differ in many ways.

Binance Margin was launched in 2019, while Binance Loans came later. With Binance Margin, you can borrow up to 5x your collateral, while Binance Loans offers only about 65% of the same collateral.

However, you can use Binance Loans anywhere you want to, including outside of the Binance platform. But Binance Margin only works on the Binance platform, and for trading. As it lets you amplify your trading results to either gain or lose more coins in a single trade.

These differences are important to note because it helps you to make more informed decisions. Binance Margin is great for trading on the Binance platform, while Binance Loans is great for all other uses.

Important terms to note

To make the most of the Binance Loans platform, you need to understand the different terms being used in offering the loan that you need. While these terms originate from the world of finance, they are common sense concepts that everyone should understand and work with.

They are as follows:

- Initial LTV – This is the Loan-To-Value ratio and is often 65%, but can vary. It simply means that whatever loan amount you can get on the platform will be worth 65% of the collateral that you are offering. So, if you have 100 BTC for instance, then you can borrow other coins only up to 65 BTC in value.

- Margin Call – Markets and prices fluctuate. So, if your collateral happens to lose value during the loan term or the asset you borrowed happens to increase in value, then the initial 65% LTV will no longer hold, as your loan’s LTV increases. A margin call is a point or percentage that will trigger a warning for you to adjust your loan or face possible liquidation. Binance will issue a margin call at 75% LTV.

- Liquidation LTV – If your collateral continues to lose value or the borrowed asset continues to gain, then the Loan-To-Value ratio will continue to rise from the initial 65%. After it gets past the 75% margin call point and nothing is done, and it then reaches 83% LTV, Binance will automatically liquidate the loan. This means selling your collateral to pay off your debt and refunding you whatever is left.

- Principal – This is the original money that you borrow from a lender.

- Interest – This is a fee charged on top of the original money that you borrow. So, you always have to repay the principal plus the interest on the loan.

- Interest Rate – This is the interest that you have to pay for a specific loan, calculated as a percentage of the principal. You can expect low percentage interest rates on Binance Loans.

- Total Interest Amount – This is the interest on the loan, calculated in the borrowed currency.

- Repayment Amount – This is a combination of the principal and the interest amount. So, mathematically, it is = Principal + Total Interest Amount.

- Loan Term – This refers to how long you want to sit on the loan before repayment. Binance offers 7, 14, 30, 90, and 180 days. Binance calculates interests daily and hourly. So, the longer you hold the funds, the more you pay.

How to get Binance loans

Getting a crypto loan on the Binance platform is simple. All you need is a verified and funded account and you could have your loan in a few moments. Here is a step-by-step guide to getting it done.

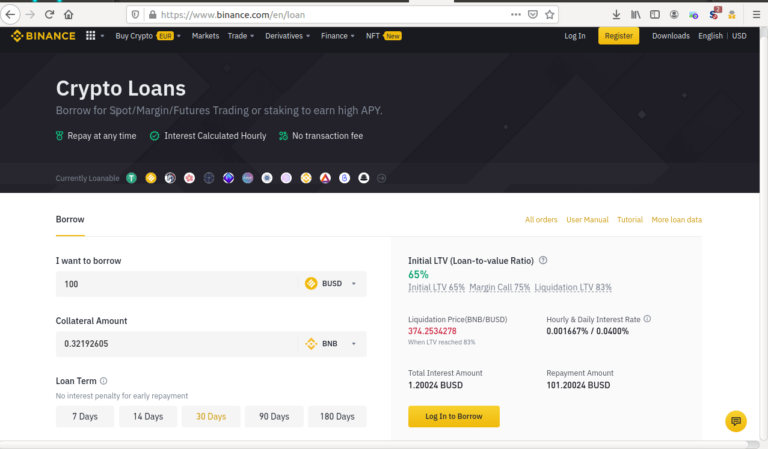

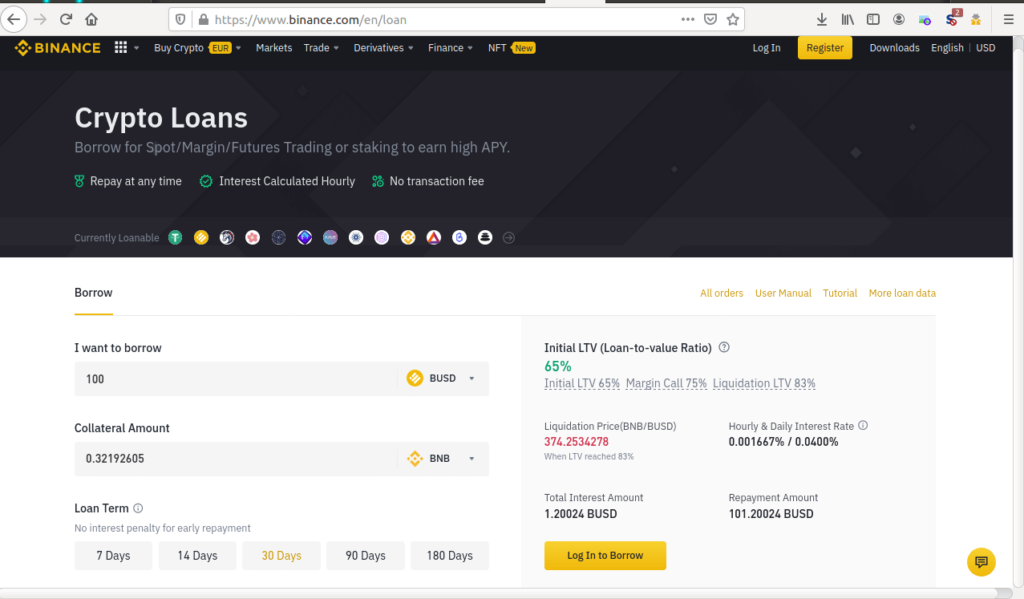

Step 1: Visit the Binance loans page

The first step is to visit the Binance Loans web page.

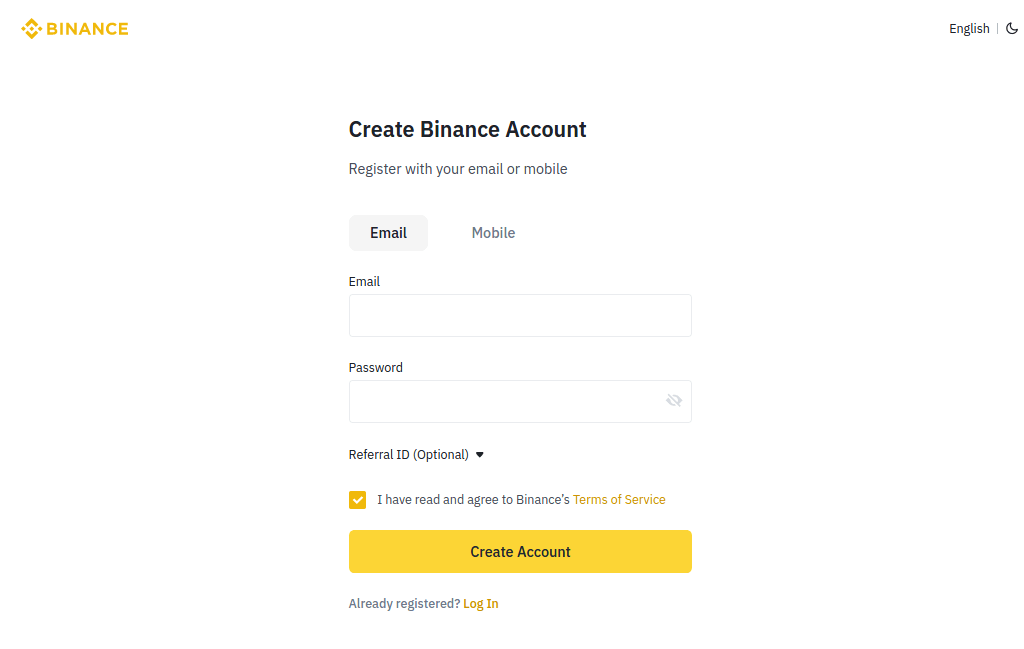

Step 2: Login or Register

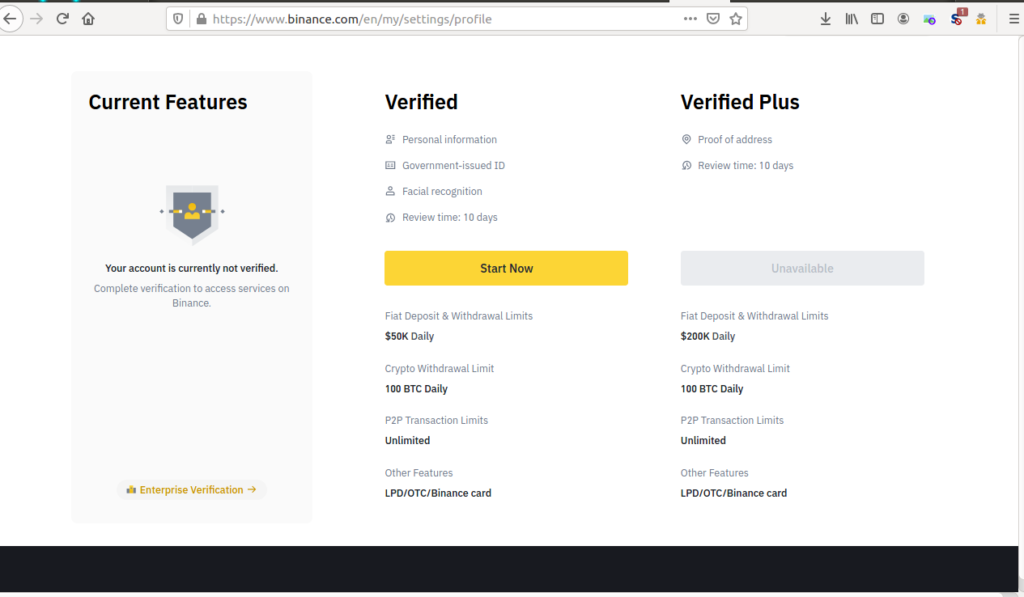

If you are already a Binance user then log in. Else, you will have to register first by clicking the “Register Now” button. Binance will send a verification code to your email address for verification.

You will also need to verify your identity after creating your account. For that, click on the “Verify” button. And depending on your country of residence, Binance will request the relevant documents.

Step 3: Load your wallet

This only applies to new users. As the “Start Borrowing Now” button will not work unless you have assets in your Binance wallet. You will also need to have assets in the specific currency that you will use as collateral.

Step 4: Select loan currency & amount

With a verified and funded account, simply head over to the Binance Loan page. Then select the cryptocurrency that you wish to borrow, as well as the amount.

Step 5: Select collateral currency

Next, you will need to select your collateral currency and the system will populate it with the required amount. Make sure that your account covers the stated value.

Step 6: Select loan term

Now, you will need to select the loan term, which is how long you need the funds for. The options here are 7, 14, 30, 90, and 180 days.

Step 7: Check & Confirm

After you have entered the desired details, you should take some time to go over the displayed loan details and make sure you are okay with them. These include the different LTVs, the liquidation price, interest rates, total interest amount, and repayment amount.

Step 8: Click start borrowing now

If all looks good, then click on the “Start Borrowing Now” button to request your crypto loan.

How to use Binance Crypto Loans

There are no defined rules for using the funds that you borrow on the Binance Loans platform. You can trade with them, buy stuff, exchange them for other coins, withdraw them, and do anything else that tickles your fancy. It is practically your asset. So, you are free to spend it both on the Binance platform and beyond.

You should keep in mind that the borrowed funds’ value is only a fraction of the collateral’s value. So, if you fail to repay the loan in time, then you should experience some asset loss through liquidation.

Repayment, Adjustments & Fees

Here are the different operations to keep in mind, with regards to accessing and managing crypto loans on the Binance platform.

- Repaying your loan – to repay your loan, simply select “Ongoing Orders” and then click on “Repay” for any loan that you wish to repay. Keep in mind that interest is first paid off, before the principal.

- LTV Adjustments – If you get a margin call and need to adjust your loan’s LTV, then you can equally select “Ongoing Orders” and then click on “Adjust LTV”.

- Overdue Payments – If your loan term ends and you haven’t yet repaid it, then it becomes overdue. Binance charges 3x the standard hourly interest on overdue loans. This grace period will last for up to 72 hours for 7-day and 14-day loans, and up to 168 hours for 30-day, 90-day, and 180-day loans. After the overdue period and you still have not paid, then the loan will enter liquidation.

- Liquidations – Liquidations are automatic and there is nothing you can do once it kicks in. If your loan enters liquidation, then Binance will additionally charge a 2% liquidation fee while paying off the loan. It will then return the remaining funds, if any, to your wallet.

Coins you can borrow on Binance Loans

Following is a list of the different crypto coins that you can borrow on Binance Loans as of October 2021. They are arranged and presented in alphabetical order.

- USDT

- 1INCH

- ALICE

- ATOM

- AXS

- AAVE

- ADA

- AKRO

- BNB

- BAT

- BAND

- BAL

- BAKE

- BCH

- BTS

- BTC

- CRV

- COMP

- CHZ

- CTK

- DOGE

- DOT

- DASH

- DAI

- ETH

- ENJ

- EOS

- ETC

- FIL

- FLM

- GRT

- HNT

- KNC

- KSM

- KAVA

- LTC

- LINK

- MTL

- MANA

- MATIC

- MTH

- NBS

- NEO

- ONT

- RUNE

- SNX

- SOL

- SUSHI

- SXP

- STORJ

- THETA

- USDC

- UNI

- VET

- XLM

- XMR

- XRP

- YFI

- ZRX

- ZEN

Coins you can use for collateral on Binance Loans

Following is a list of the different cryptocurrencies that you can use as collateral on Binance Loans as of October 2021. They are arranged and presented in alphabetical order.

- ADA

- AXS

- BCH

- BNB

- BTC

- BUSD

- CAKE

- DAI

- DOD

- DOGE

- DOT

- EOS

- ETH

- LINK

- LTC

- MDX

- SOL

- UNI

- USDC

- XRP

Conclusion

We have reached the end of this simple guide on how to get and use Binance crypto loans and you should hopefully have everything you need by now.

Remember that you can do whatever you want with the borrowed crypto funds, including withdrawing them. A crypto loan is a smart answer to fast cash without liquidating your crypto assets. And Binance Crypto Loans is your best solution for now.