How To Start Trading Forex On HFM

Are you looking to trade Forex with HFM? Here is everything you need to take on the market and become profitable.

Forex trading is a risky but lucrative business that is available to everyone in most parts of the world. It can be tough to learn but the rewards are worth it.

If you are new to Forex trading and want to succeed, it’s best to take it as a business and first learn the basics before making your very first trade.

This guide shows you how to start trading Forex with the beginner-friendly HFM broker. It includes the important tips to remember and steps to take you to profitability.

Why HFM?

There are many good brokers out there, so why HFM? Well, HFM offers a Cent account, which is a great option for beginners. A Cent account offers minimal risk because its lot sizes are 1/100 of a standard account. This makes it possible to trade with real money but with minimized risk.

Additionally, their low $5 minimum deposit makes it easy to start trading with little money. HFM also offers other account types and supports the popular MetaTrader 4 and 5 trading platforms.

What You’ll Need

Here is everything that you’ll need to start trading Forex on HFM.

- HFM Trading Account: You have to register with HFM for a trading account that gives you access to the markets.

- A Strategy: Most importantly, you need a strategy that enables you to properly analyze the markets and to enter and exit trades at the right moments, so you can be profitable.

- A Trading Plan: In addition to a strategy, you need an overall trading plan. It should include a fixed trading schedule, for instance, trading only in the mornings or the European or US session only. Your plan should also include your preferred trading instruments, your risk management approach, daily or monthly profit targets, and any other unique details that will help you to develop a personal trading style.

- Computer or Mobile: You will need a computer or a smartphone to trade. Most Forex trading software include a charting system that lets you visualize the markets. HFM offers the Metatrader 4 and 5 platforms which do not require too much system resources to run and are additionally available for mobile phones.

- Money: Finally, you need to deposit some money in your trading account because trading is all about using money to buy and sell. While some brokers might require a minimum deposit of $100 or even higher, HFM offers the CENT account with a low minimum deposit of just $5.

Beginner Trading Strategies

Your success as a Forex trader will depend to a large extent on your trading strategy. Not trading with a strategy simply means that you are gambling, while trading with untested strategies just exposes you to unnecessary risks.

You want to learn and stick to a simple, but proven strategy that has helped other traders to make some money. Such a beginner strategy does not need to be perfect, but once you’ve got your feet wet in trading, you can slowly test other strategies or even develop yours.

The easiest beginner trading strategies include:

- Trend Following: This strategy is as simple as it sounds. All you have to do is zoom out of your charts, see if the market is going up or down, and enter the market in the same direction. If the market continues in that same direction, then you let the trade run. Else, if prices turn against you, then you take a small loss by closing the trade.

- Breakout Strategy: When the market is not trending up or down, it is said to be consolidating sideways. In this case, you can identify the highest and lowest prices during this consolidation–using a trend-line, for instance. Then once market prices break above or below the consolidation range, you join the market in the same direction.

- MA Crossover Strategy: The moving average or MA is probably the easiest technical indicator that you can use in trading. All you need for this strategy is to apply two moving averages on your chart, with one having a longer period (e.g 20 bars) than the other (e.g 5 bars). Now, whenever the MA with the shorter period crosses from below to above the longer MA, you buy into the market or close your sell order, and when it crosses from above to below, you sell or close your buy order.

Trading Personalities

Another important thing to be aware of is your trading personality. This defines the type of trader that you are or would like to be. You should clear this issue upfront so you know what you are doing and where you are headed.

There are four major groups that most traders fall into, so find which one best suits your temperament and risk tolerance below:

- The Scalper: This trader can hold a trade for as little as just a few seconds or for a few minutes. He aims to profit from small changes in prices and does it over and over again throughout the day. A scalper typically works on 1-minute and lower time-frame charts and can use a variety of trading strategies, including trend following, price action, and moving averages.

- The Day Trader: Those who typically trade between the 5-minute, and 60-minute charts are day traders. They aim to hold trades from a few minutes to a few hours and may open 2-3 positions in a single day. They also typically close all open positions at the end of the day, unlike swing traders.

- The Swing Trader: This trader can hold a position for periods between a few days to many weeks, often longer than a month. The swing trader aims for significant market moves that can return many hundreds of pips in profit. Swing trading is also a great approach for busy professionals who want to trade in their free time, as it requires way less time commitment than scalping and day trading.

- The Position Trader: A position trader focuses on long term trends that can last for many months or even years. The position trader is typically not concerned with short- and medium-term price variations. He will often combine technical and fundamental analysis approaches to arrive at a trade decision. A good percentage of position traders invest huge sums of money.

Steps To Start Trading On HFM

Now that you have a better understanding of what it takes to trade the Forex markets, it is time for a step-by-step guide to doing it with HFM. First register with HFM.

Step 1. Learn The Basics

If you want to succeed as a Forex trader, then you need to know the basics–margin, a pair, a lot, a pip, leverage, commission, a stop, a limit, risk management, and so on. If you haven’t learned these already, HFM has a lot of free educational materials and webinars to help, you can also visit the Babypips School of Pipsology if you want a course on forex.

Step 2. Choose A Strategy & Time-frame

As stated in the trading personalities section above, you have to find the time-frame that best suits your temperament or schedule and stick to it. Jumping from 1-minute charts to 4-hour or daily charts isn’t a sound approach.

You also need to choose one beginner-friendly strategy and stick to the strategy and your selected time-frame.

Step 3. Choose A Platform

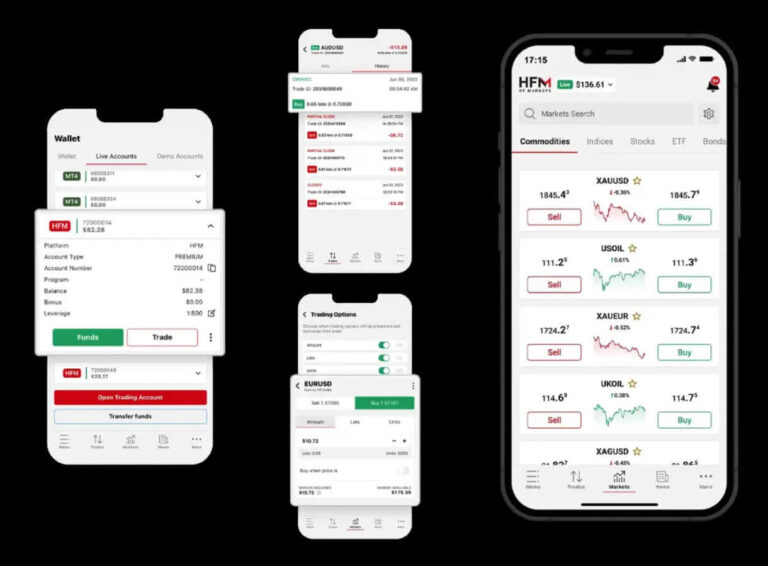

Your choice of a trading platform can seriously impact your trading results. So, you equally need to spend a good amount of time to choose the right trading software. HFM offers Metatrader 4 and 5, as well as the HFM platform, which lets you trade using the HFM app.

For Metatrader, version 4 is the most popular, while version 5 is more modern and can handle more compute-intensive loads.

Step 4. Select Instrument

Forex trading instruments are quoted in pairs. For instance, EUR/USD for Euro priced in US dollars, GBP/USD for Great Britain Pounds priced in dollars, and so on. There are dozens of such pairs available for trade, but you should just choose one for the beginning. EUR/USD and GBP/USD are the most popular and liquid, but other major pairs include USD/JPY, USD/CHF, AUD/USD, and so on.

Step 5. Create A Demo Account & Practice

Now that you have everything set up and ready to go, it’s time to open a practice account and start testing the waters. Head over to log in page and register your new account. Then log in and create a new Demo account under My Trading Accounts >> Demo >> Open Demo Account. Please note that it is advisable to start trading with a demo account until you have mastered the markets before opening a Live account.

Step 6. Open A Live Account

Once you’ve learned the ropes of Forex trading and you can see yourself making profits, then it’s time to transition to a Live account. Log back into your HFM account and and create a new Live account under My Trading Accounts >> Live >> Open Live Account. Select the CENT account option, as it offers the lowest risk for beginners.

Step 7. Fund Account & Trade With Real Money

You can now fund the account and start trading with real money, keeping in mind that you will be getting more emotionally invested in each trade now than you were when trading the demo account. However, if you can keep your emotions in check and stick to your trading strategy, then your wins and profits will soon start to pile up.

Frequently Asked Questions

Here are some frequently asked questions regarding Forex trading on HFM and beginners.

Q: Is there a 100% successful Forex trading strategy?

A: No, there is no 100% successful trading strategy. The moto is: “you win some, you lose some”. A successful strategy, however, helps you to win more than you lose.

Q: What is the secret to success in Forex?

A: The secret to success in Forex and trading in general is to find a profitable trading strategy and stick to its rules. You can either learn a proven system (recommended) or develop yours.

Q: How much money do I need to start trading Forex?

A: You should take Forex trading as a business and treat it as such. So, like every other business, it’s best to start small and grow from there. Luckily, HFM offers the CENT trading account with a $5 minimum deposit.

Q: Is manual trading or robots better?

A: This is a very difficult question, because most robots are just the automation of a manual trading strategy. If you want to become a successful trader, then you need to learn manual trading. However, automated trading takes away negative human trading disadvantages such as fear, greed, and exhaustion.

Q: Can anybody trade Forex?

A: Yes, anybody that is capable of learning and following the rules of a profitable trading strategy can trade Forex. Most brokers, however, only accept traders that are 18 years and older.

Conclusion

Forex trading is not easy to learn, but it is worth learning and with the right tools such as a practice account and HFM’s Cent account for beginners, you can learn the process and hopefully become profitable.

In the end, remember that trading is a business. So, you should approach it as such by learning all you can, starting small, and keeping your emotions at bay.