Zero Cost Collar: Meaning, Benefits, Pros & Cons

Zero Cost Collar can protect against risk but it also has its disadvantages. Here is everything that you need to know.

In the stock market, risk encounter is inevitable. Dexterous investors are not exempted from running the risk of a downslide in their investment. Rather, they apply a well-thought risk management strategy that would prevent their investments from completely diminishing.

Minimizing risk is necessary if investors must make a profit from the security they’ve invested in. Thus, we’ve discussed here, an effective risk management strategy that can be applied when investing in futures and options.

What is Zero Cost Collar?

Zero cost collar is a trading strategy that is applied to reduce risks. It is a form of an options strategy that the investor employs to cut losses by purchasing call and put options.

The term zero cost collar can be used interchangeably with zero-cost option or hedge wrapper due to its application. A good example of zero cost collar option purchase is buying a put and selling a call at a lower strike price.

The goal of this trading strategy is to minimize losses encountered during trading and maximize potential gain on stock holding. When the investor purchases stocks(that have in time past produced good returns on investment) to hold for a long time, the risks are reduced minimally. Thus, the zero cost collar strategy is commonly used for long-term investment in options.

How Does a Zero Cost Collar Work?

The zero-cost collar strategy is essentially applied to mitigate the risk of running at loss during declining markets. The put option in this strategy prevents the investor from losing the gain accumulated over the long-term holding periods without needing to put the stock up for sales. Thus, to create a cost collar by crediting the account with a small amount, the investor selects a put option that is farther out of the money than the respective call option. The investor buys a protective put option and sells a covered call.

The investor also typically benefits from the zero-cost collar strategy by deferring taxation associated with sales of the intended stock and dividend returns from long-term holding of the stock.

The zero cost collar strategy is generally used in bearish markets by eliminating out-of-money options from the investor’s portfolio.

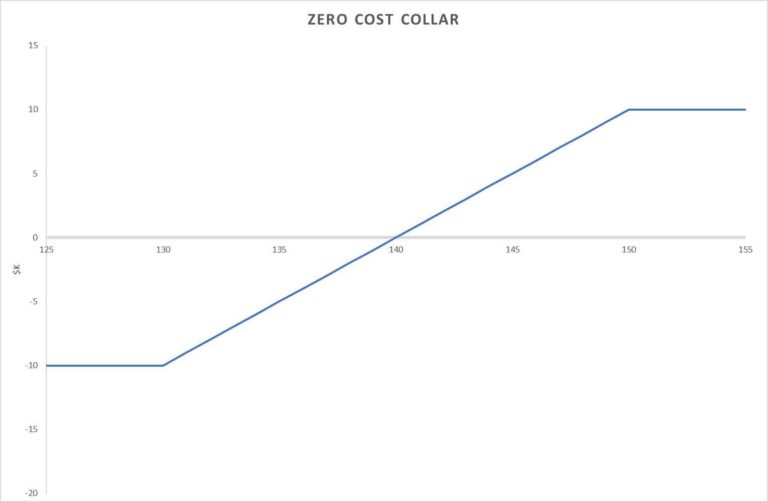

Often, options traders or investors use this strategy when the underlying security price is greater than the strike price call option sold. Therefore, the investor’s maximum loss is the purchase price of underlying stock minus the strike price put option purchased. Also, the maximum possible gain is the difference in underlying security price which is lesser than the strike price of the purchased call option.

Although this strategy may seem straightforward and shows promise for future returns, it must be mentioned that it is somewhat difficult to establish and execute.

Benefits of zero cost collar

The zero cost collar strategy is beneficial in the following ways.

1. Reduced Risks

Say there is a fall in share price rather than a rising (perhaps by the prediction made by the investor holding to shares with the expectation of an upward trend in the market). The investor or trader doesn’t have to accept losses and put shares up for sale at a lower price. The investor still has the opportunity to sell at the listed price in the put option.

2. Retention of investments

Due to the market fluctuations and downward trends, the investor may want to hurriedly exit the market. However, the investor does not have to quit the market, especially if by prediction a recovery and stock price increase are foreseeable at a future date.

3. Assurance

Anxiety and worry start popping up when we are uncertain about the outcomes of investments, especially those which is of a high value. A Zero Cost Collar guarantees you calmness of mind as you are assured that you will not run at a loss in the end.

4. Cost is offset

In Zero cost collar, the investor is not exposed to additional costs, because the cost of the put option is offset by the sell of the call option.

Some other benefits of a Zero Cost Collar risk management strategy are;

- The investor is covered by the zero cost collar from significant diminishing in the value of the investment

- The zero-cost collar strategy protects the investor or trader even when there is a fall in the stock index.

- With Zero cost collar, investors are guaranteed a potential return on investment.

Factors to be considered when applying zero cost collar option

1. Limited Earnings, as you experience limited or minimized losses, equally also you’ll have limited gains.

2. Timing, a rise in market price can be missed due to inconsistent periods in trading.

3. Zero Earning, zero cost collar strategy guarantees your protection from losses, however, your earnings are not certain as well. There is the probability that you might earn nothing at the end of the day.

Pros and Cons Of Zero Cost Collar

Some of the advantages of using zero cost collar are:

- It reduces the downside risks associated with stock trading by protecting at zero net cost.

- A zero cost collar can be used to correct stock future value to a narrow margin, and thus guarantees payouts in the future.

- With this risk management strategy, investors can receive dividends provided they hold shares or own stocks.

On the other end, the disadvantages of zero cost collar are:

- Once a cost collar has been placed, the stock position becomes limited.

- In most cases, investors may not find suitable calls and put options having similar premiums to execute a zero-cost collar.

- Due to uncertainties and market volatility, out-of-money put options are very often priced higher

- Zero cost collar trading strategy is complicated in that it possesses a double options position, thus, subject to additional transaction costs.

Conclusion

Zero cost collar can serve the experienced trader or investor by managing high risks investments. In setting out to grow a portfolio, the investor must learn to calculate and predict the stock market, and with Zero cost collar minimize the risk of downside or significant loss.