10 Best Forex Trading Platforms in 2025

Retail Forex trading’s explosion brought many software innovations with it. Today, there are dozens of Forex trading platforms available to a wide range of customer demographics.

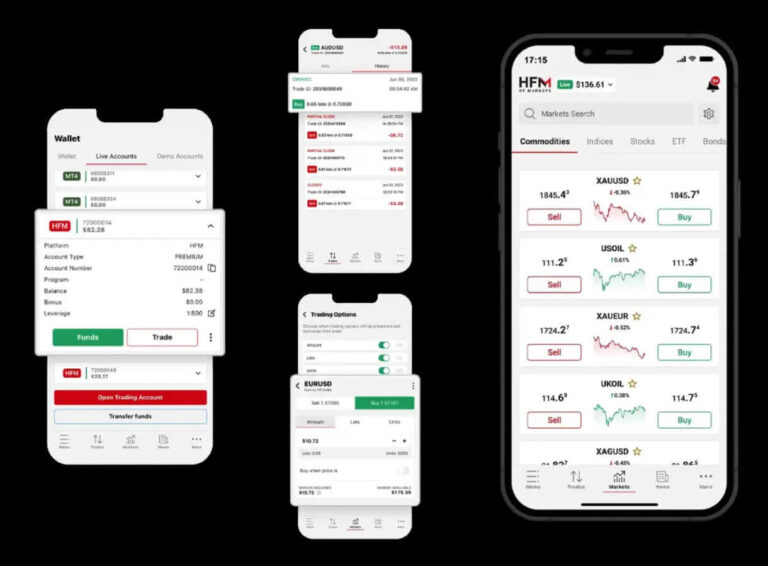

Note: The best forex broker is HFM

All these Forex platforms are not equal, however. Some perform better with fundamental traders, while others are great for technical traders. Many also come with additional features that make them ideal for certain groups.

This post looks at the top 10 Forex trading platforms in the market. It looks at everything from their layouts to pricing, programming languages, order management, and other design features that might make them a better choice for you.

Tips for Choosing a Forex Trading Platform

We all have different needs. Some people want to learn and become great traders. Others only want to know enough to manage trading robots. While many more enjoy the novelty or thrill of speculation, and so on.

Whichever group you may fall into, the following tips will help you to make the best of your time in the financial markets.

- Trading platforms help you to analyze the markets and place trades. But you need an account from a broker to trade real money.

- Some trading platforms are broker-specific and often developed in-house. While others are independent and offered by different brokers.

- Mobile apps let you trade on the go, but their functionality is relatively limited.

- Browser-based web platforms are great, but they are less impressive than desktop applications.

- Forex trading is a serious business. So, get a trading education first.

- You can lose all your money in just 3 seconds. So, you should learn first, before you start trading. You will need 1 to 3 years at the least to know what you are doing.

- Start with a demo account until you have a proven, winning strategy before you can think about committing real money.

- Never trade with an unregulated broker. They are bucket shops.

We recommend you use a broker like HFM for beginners.

The Best Forex Trading Platforms

| Name | Best For | Price | Website |

|---|---|---|---|

| Metatrader 4 | Overall | Free | metatrader4.com |

| Metatrader 5 | Heavy Algorithms | Free | metatrader5.com |

| JForex | Excellence, liquidity | Free | dukascopy.com |

| TradingView | Powerful online platform | Freemium | tradingview.com |

| Ninja Trader | User interface | Freemium | ninjatrader.com |

| eToro | Social/copy trading | Free | etoro.com |

| cTrader | Speed, performance | Commission | ctrader.com |

| Currenex | Institutional, hedge funds | Commission | currenex.com |

| Trading Station | User friendly | Free | fxcm.com |

| Eikon | Liquidity, fundamentals | $300-$1800 /m | refinitiv.com |

1. MetaTrader 4

- Highlights: Most popular platform, versatile, thousands of free indicators

- Cons: 32-bit, single-thread architecture

- Price: Free

- Website: metatrader4.com

The MetaTrader 4 from MetaQuotes, also called MT4 is the most popular platform for Forex traders worldwide. It comes with 30 built-in technical analysis tools from Fibonacci to Gann and channels.

MT4 offers nine time-frames from 1-minute to monthly charts, meets the highest security standards, and is broker independent. You can use it to connect to hundreds of brokers through thousands of servers.

What makes it so popular, however, is its easy-to-understand and use programming environment. It lets you create custom code that does whatever you like and attach it to the main program easily.

As a result, countless traders have created countless add-ons for the system and thousands are available for free. This makes MT4 the perfect platform for all traders to experiment with the widest range of trading philosophies.

You can trade manually from the chart or use market signals and copy trading. You can also buy trading robots and indicators from the market, receive market news, or manage a highly complex trading robot on MetaTrader 4. It is very versatile.

MetaTrader is also available as web and smartphone apps. However, their functionalities pale in comparison to the desktop version. But they make it easy to monitor your positions on the go.

The system has a downside though. It is a 32-bit, single-thread program from the days before multi-core CPUs. So, while you may still run it on a 64-bit system, there are performance limits.

In the end, MetaTrader 4 will slow down your system if you have super-complex calculations. You can solve this problem a bit by optimizing your code, but MetaQuotes Software came out with the right solution in 2010; MetaTrader 5.

2. Metatrader 5

- Highlights: Multi-threaded, native 64-bit, more indicators

- Cons: Different language from MT4

- Price: Free

- Website: metatrader5.com

Take everything that MetaTrader 4 is, then add native 64-bit and multi-core CPU support. Include more indicators and time-frames, and you have MetaTrader 5.

The MetaTrader 5 platform is technically ahead of MetaTrader 4. It offers 38 technical indicators, eight more than MT4, and 21 time-frames, including 1-minute, 2-minute, 3-minute, and so on.

There is an integrated economic calendar, market depth, and unlimited charts. In practice, each new chart gets automatically allocated to a CPU thread. This balances the computing load, so you are only limited by your hardware specs.

MT5 is also available for the web and smartphones, including Huawei apps. There is a Hedge Fund version for Hedge Fund managers, with access to 80 global exchanges and liquidity providers for everything from Forex to stocks, bonds, indices, metals, and cryptocurrencies.

With all its features, MT5 is still less popular than MT4. The reason is that it comes with a new programming language called MQL5. And many who already work with MQL4 do not want to switch.

So, if you are new to Forex trading and have not invested in Metatrader 4, then choosing MT5 might be a wise decision.

3. JForex

- Highlights: Flexible, extensive features, visual builder

- Cons: Only for Dukascopy clients

- Price: Free

- Website: dukascopy.com

Dukascopy is a Swiss bank that offers Forex trading to clients from all around the world. They have an impressive in-house platform called JForex, and it is currently in version 3. It runs on Dukascopy’s SWFX ECN liquidity marketplace and delivers detailed Level II market data.

JForex is sleek but highly efficient. It lets you trade manually or with automated algorithms. It also comes with a strategy builder, which includes a visual builder for traders without coding skills to create their strategies using drag-and-drop.

Another impressive part of Dukascopy is that the platform provides near-institutional features. You can trade up to 50 million EUR/USD and higher within a tight 0.2-pip spread and with strict maximum slippage rules.

JForex 3 offers 270 indicators, economic news, a cloud server for automated trading, a multi-language interface, and support for Windows, macOS, and Linux platforms in 32 and 64 bits. It is also available for the web, Android, and iOS platforms.

Dukascopy offers the same tight spreads and other trading conditions to all its clients, as they only have one account type. You can also set strict slippage rules and even engage in market making. But JForex is only available through Dukascopy.

4. TradingView

- Highlights: Browser base, 100+ indicators, extensive features, huge community

- Cons: No desktop version

- Price: Freemium

- Website: tradingview.com

Founded in 2011, TradingView is a web trading platform that includes a social network where traders can analyze the markets and share ideas.

Powered by JavaScript and the ever-increasing power of personal computers, TradingView can turn any web browser into a fully-fledged trading station. This includes over 100 inbuilt indicators and thousands more created by its millions of users.

All you have to do is connect your TradingView account to your broker of choice, and you are trading the markets already. They include major brokers for Forex, stocks, cryptocurrencies, and other tradeable assets.

Basic accounts are free, but you get the option to upgrade for more features. Indicators and scripts on the platform run on the Pine programming language, which is similar to Python. And there are also smartphone apps for Android and iOS.

5. NinjaTrader

- Highlights: Top quality tools, detailed charting, C# programming

- Cons: Relatively pricey

- Price: Free to $1,099

- Website: ninjatrader.com

NinjaTrader is both a trading platform and a broker. The platform offers excellent charting features and is great for those who want the best technical analysis tools.

You get all 5ypes of bars, from different candlestick variants like Heiken Ashi to Renko, Kagi, and Point and Figure. There are also different chart types, a special chart order entry interface, market analyzer, advanced alerts, and so on.

Asides from the free simulation version, NinjaTrader comes in three variants. There is a basic package that is available for free to clients of the NinjaTrader brokerage. This account for futures trading requires an initial deposit of $400. For Forex trading, you will have to choose an external broker based on your location. And this determines the minimum account opening deposit.

Then, there is the leased version for $720 per year with more features. It is called Trader+ and includes Chart Trader, OCO orders, position auto-closing, advanced alerts, automated trading, and much more.

The lifetime license package costs $1,099 and includes Order Flow+, which offers volumetric bars, Trade Detector, market depth, and more. You can further customize NinjaTrader with thousands of add-ons.

6. eToro

- Highlights: Social trading, 2,000+ instruments, easy to use

- Cons: No desktop version

- Price: Free

- Website: etoro.com

eToro is a broker, social network, and broker for traders. It has millions of members from over 140 countries and is popular for its copy trading features.

Simply register on the site, search for social investors, and copy the trades of any trader you like. Your account will now trade a predefined amount each time the investor makes a trade.

You can search for traders by performance, risk score, and other criteria. eToro offers over 2,000 financial instruments, including Forex, cryptocurrencies, and stocks. You can also copy entire portfolios.

The platform is for web and apps only, with features for both beginners and expert traders. It features demo trading, 66+ indicators, 13 drawing tools, and trailing stops. The Android and iOS apps, however, have limited features.

Minimum deposits depend on your region. In some countries like the U.S., Germany and Austria, it is $50. While it is $1,000 in Kazakhstan, and up to $10,000 in Israel, where eToro was founded in 2007.

7. cTrader

- Highlights: Execution speed, performance, advanced features

- Cons: No free version

- Price: Commission based

- Website: ctrader.com

Traders who need a top-quality trading platform with all the expert features you can ask for, should checkout cTrader.

This platform includes everything from 9 chart types to 70+ pre-installed indicators, detachable charts, responsive chart trading, and fast order execution with simultaneous processing.

There is also Level-II pricing and advanced order protection features. These include multiple stop-loss triggers, multiple take-profit levels, and 9 order types to fit any strategy.

cTrader is available from many leading brokers, but it is not free. You will have to pay a commission for using it, usually about $50 per million traded.

8. Currenex

- Highlights: Deep liquidity pool, reliable platform

- Cons: Not for small timers

- Price: Commission based

- Website: currenex.com

Established in 1999, Currenex is an online platform for serious market players. It offers electronic trading in FX spot and forward contracts. With the majority of its clients being large banks, corporations, governments, and hedge funds.

Currenex is a true ECN (Electronic Communications Network). The liquidity is deep and there is little limitation on how much funds you can transact at a go. This network has clients from around the globe and you can connect via the Internet, through a private network, and even directly from a data center.

There is no purchase price for the platform, except in situations where you need to connect through other means than the normal Internet. Then extra costs may apply. Else, payments are commission-based. Meaning that you pay a fixed dollar price of about $5, for every million dollars transacted.

9. Trading Station

- Highlights: User friendly, tons of add-ons

- Cons: Exclusive to FXCM

- Price: Free

- Website: fxcm.com

Founded in 1999, FXCM Group is a popular broker with a proprietary platform called Trading Station. This platform is user-friendly, intuitive, and easy to use.

You can use it for manual and automated trading. You can trade from charts, backtest your strategies, and access thousands of free plugins for the platform.

Trading is available down to micro-lots, which are $1,000 notional, equal to 1/100 or 0.01 of a standard lot.

It should be noted that the CFTC banned FXCM from operating in the United States since February 2017. As the company was caught cheating its customers. They continue to operate in other regions around the world though.

FXCM caters to a wide range of traders, from beginners to more advanced speculators. And their fees are okay, but not impressive. Its Trading Station platform, however, remains one of the best for trading Forex.

10. Eikon

Highlights: Real-time news, global financial data, extensive features

Cons: Relatively expensive

Price: $300 to $1,800 per month

Website: refinitiv.com

The Refinitiv Eikon is a financial monitoring and trading platform originally developed by Thomson Reuters in 2010. It is designed to compete with the Bloomberg Terminal, the traditional platform used extensively by Wall Street investors and traders.

You get top financial news and Reuters breaking news, important tools for fundamental analysts and traders. But Eikon also connects you to equities, commodities, fixed income, and corporate treasury trading, in addition to real-time Forex rates of over 500 pairs from 2,000+ sources.

Further features include charting tools, alerts, customizations, Excel integration, and highly flexible API access. Eikon is also available for the web, iPhone, and Android platforms.

Eikon varies in cost, as opposed to the $20,000 – $24,000 per year cost for the Bloomberg Terminal. The stripped-down version costs as little as $300 per month and it goes up to $1,800 per month for full features.

Conclusion

We have come to the end of this list of the top Forex trading platforms out there. As you can see, the competition is hot, so there are tools and solutions for all types of traders.

Feel free to choose any platform you can identify with, but note that the best trading tools are useless without a winning strategy. So, get that trading education as well.