5 Easy Steps For Beginners To Start Earning With Forex

Are you looking to earn from the Forex market without being a finance guru? Here are easy steps to do that.

The Forex market is very large and presents many opportunities for both experts and beginners to earn profits.

Many people look toward Forex as a means to earn supplemental income, so they may not have the time for a detailed study of the market and its intricacies.

Still, beginners at all levels can make some money from Forex by taking any of the following five steps.

First, you need to register with a broker. Below is our recommendation:

- Exness: Create an account with Exness. Exness is well regulated and great for beginners.

- Derive: Create an account with Deriv. It is more flexible and available in more countries.

1. Learn A Simple Strategy

If you are a Forex beginner hoping to become a successful trader down the line, then the best option for you is to learn a simple strategy and start trading with it.

There are a few well-known beginner strategies you can learn, such as the breakout strategy, trend-following, 1-2-3, and moving average crossover. Each strategy has its pros and cons, but remember that you will need to know Forex trading basics before you can start trading with a strategy. A good place to learn these basics is the Babypips School of Pipsology.

Once you have covered Forex trading basics, then here is a quick rundown on what each of these beginner strategies is all about.

- Trend Following: When prices are either moving upward or downward in trading, you say the market is trending. A trending market is easy to identify with the naked eye. All you have to do is zoom out of your charts well enough to identify the trend and simply join the ride. Trend following is as simple as that, although you could further improve your strategy by adding a technical indicator, such as trendlines or a moving average to better help your analysis.

- Breakout Strategy: The breakout strategy is relatively simple if you have the patience to wait for a non-trending (flat) market to start trending. Once you identify consolidating prices that are neither going up nor down, simply draw one horizontal line below that matches its lowest price and another one above that matches the highest price for that period, then patiently wait until prices either break above or below any of your horizontal lines and join the market in the same direction.

- 1-2-3 or A-B-C Pattern Strategy: Another simple but effective beginner strategy is the 1-2-3 or A-B-C pattern, named after the three pivot points that form its basis. All you need to do here is to identify three points, draw a line, and wait for prices to break your line. For a buy signal, for instance, point 1 will be the most recent lowest point, then point 2 will be a high price after point 1. Point 3 is subsequently a low point after point 2 that remains higher than point 1. Now, once prices cross the horizontal line that you drew from point 2, you buy. The reverse is true for a sell order.

- Moving Average Crossover: The moving average (MA) is a simple but efficient technical indicator. It calculates the average price over a given period and can be very helpful in trading and statistics. A moving average plots its values successively, so you get a smooth line on the chart showing the trend. If you combine two moving averages with different periods, however, then the MA with the shorter period will be higher than that of the longer period during an uptrend. Similarly, the shorter MA will be lower than the longer MA during a downtrend. With this information, all you need is to wait for the two MAs to cross to enter a trade. For instance, when the shorter MA crosses from below to above, you buy. When it crosses from above to below the longer MA, you sell.

2. Start Copy Trading

If you are not interested in becoming a good trader, but you know the Forex basics and just want to make money, you can copy the trades of seasoned traders and earn with them using copy trading.

Copy trading is a part of social trading, which means trading together and communicating with other traders. It is implemented differently on various platforms and by various brokers, but the fundamental idea remains the same – a seasoned or professional trader offers his trading information on the platform for others to copy for either free, for a fixed monthly price or for a percentage of the follower’s earnings.

The good thing about copy trading is that you can follow as many good traders as you want. Most platforms present the traders’ statistics, so you can analyze and see how often or aggressively they trade. You may also find which instruments they trade and how many followers they have.

You will find some of the best traders to copy-trade on Exness and Deriv.

3. Subscribe To A Signal Service

A trading signal is another type of social trading that involves periodic information about potentially profitable trade setups, estimated stop-loss, take-profit, and so on. However, unlike copy trading where the trades are automatically executed on your account, a signal service only provides the information and you are free to trade however you like.

As you can imagine, a signal service is ideal for a serious trader who aspires to improve with time because you can combine the signals with your personal analysis to reach final trade decisions.

There are quite a few signal services out there, but two platforms worthy of mention are MQL5.com and 1000PipBuilder.com. The MQL5.com signals platform offers you access to a wide range of traders from all over the world who you can subscribe to for different prices. The signals are delivered to your Metatrader software and you can either let it execute automatically or manually. 1000PipBuilder, on the other hand, is a standard signal service that costs from £19 per month with yearly billing.

4. Buy A Robot

The truth is, algorithmic trading is profitable and it’s only getting better with artificial intelligence. Algorithmic trading is the use of software robots to analyze financial markets and take trades either with partial or zero human support.

All you need to trade Forex with a robot is to set up your computer to run 24/7 and leave the robot active on it. If you are unable to have your computer run non-stop, then you can consider renting a VPS to run the robot on.

One problem with trading robots though is there are so many of them out there that it’s difficult to know who to trust because many are marketed with outrageous claims of making 1,000% profits in just a few days, and so on. Others use excessively risky tactics such as bad money management that may help them achieve quick wins, but burn the account with just two or three successive losses.

The MQL5 market platform solves all these problems by providing access to top expert advisors (Metatrader robots) for both its Metatrader 4 and 5 platforms. The robots range from free to paid and you can see each robot’s price, the most popular for each platform, the top sellers, and most importantly, reviews and comments with valuable feedback from previous buyers and users. This abundance of information should make it easier for you to choose a profitable robot.

5. Use PAMM

PAMM stands for Percentage Allocation Management Module and is a technology that allows professional traders to manage funds for clients. Such a professional can solicit funds from 5 or 10 clients and combine them into one large account. Then, the account is divided by the percentage of each client’s contribution, so the trader knows how much to compensate each client at the end of the month or year.

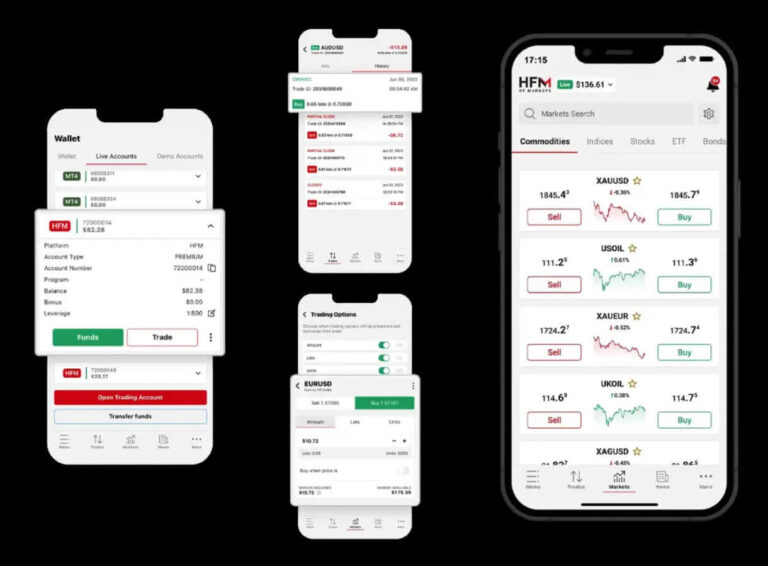

Many Forex trading platforms offer PAMM functionality but the real job lies in finding a good trader that you can entrust your funds with. The brokers will help you as an investor in this regard. Some of the outstanding brokers with PAMM platforms include HFM and Exness.

Frequently Asked Questions

There are many questions out there concerning the Forex market and how beginners can earn from it. Here are some of the top ones.

Q: Must I be a trader to start earning with Forex?

A: No, it is not necessary to be a trader or an expert in the Forex market before you can earn from it. You can invest in proven systems, such as a trader or robot with a proven track record.

Q: How much can I earn from the Forex market?

A: You can earn enough money from the Forex market to live a good life. There are no upward limits, as some top traders are on record to have earned billions of dollars from the market. Your success will depend on the specific system that you are using.

Q: How risky is Forex?

A: Forex is a high-risk market that can be brutal if prices go against you and you don’t take the necessary precautions. Successful traders focus on minimizing this risk by developing strategies with tight stop-loss protection for each trade.

Q: Which currencies can I trade in Forex?

A: Most currencies are available to trade, especially the major world currencies. Brokers list the currencies in pairs and they are often grouped as the majors (EUR/USD, GBP/USD, USD/JPY), minors (EUR/GBP, CHF/JPY), and exotics (EUR/TRY, USD/SEK).

Q: Can I get scammed in Forex?

A: Yes, you can get scammed in many areas of the Forex market. You could get scammed by someone selling you a robot that is no good, by subscribing to a bad signal service, or even by registering with a shady broker.

Conclusion

You have seen the different methods with which you can make money from the Forex market and the right steps to make it happen. Each method has its pros and cons, as well as different Forex skill requirements.

Remember that the Forex market is huge and brutal, so it’s best to treat it as a business by deciding critically and without emotions, which of these methods will be the best and most profitable for you to start earning.