6 Best Forex Brokers To Use in 2025

Are you looking for the top Forex broker to trade with? Here are the very best for your different needs.

Forex is the largest market on earth, with trillions of dollars exchanging hands daily. A Forex broker helps you get in on the action by providing software and communication tools.

There is a wide range of Forex brokers around the world, with some specializing in new traders. At the same time, others focus on professionals and big accounts or include other groups of tradable instruments.

This review of the top Forex brokers aims to provide you with all the information necessary to choose the best company for your needs.

Tips For Choosing A Forex Broker

Here are a few tips to keep in mind to help improve your judgment of the different Forex brokers out there.

- Regulation: The Internet can be a wonderful place until you get scammed—like sending money to people you don’t know. Regulators are financial industry overseers for the specific region in which a broker is domiciled. A good broker should be regulated by a competent regulator to ensure that your money is in safe hands and the more regulators you find regulating a single broker, the better their standing. Some of the best regulators include the ASIC of Australia, the UK’s FCA, and the CySEC of Cyprus. Stay away from unregulated brokers and those domiciled in questionable offshore jurisdictions such as St. Vincent and the Grenadines.

- Currency Pairs: The number of currency pairs is another major point of concern. If you are looking to trade only the major pairs such as EUR/USD and GBP/USD, then there is little to worry about. However, if you are looking to trade exotic pairs such as USD/RUB or USD/SGD then you will need to make sure that the broker offers as many pairs as possible. Some brokers offer up to 80 or more pairs.

- Spread: The spread is the difference between the broker’s Ask and Bid prices. The Ask is the price at which you can buy a currency pair, while the Bid is the price at which you can sell it. Brokers always quote a currency pair’s Ask and Bid prices at the same time. You want a broker that offers you the tightest possible spreads because the tighter the spreads, the more money you make.

- Minimum Deposit: Opening a Forex brokerage account requires you to first register an account and verify your identity, before funding the account. Some accounts allow as low as $1 for initial deposits, while others require $10, $50, $100 or more before you can start trading.

- Software Platforms: Most brokers offer trading software platforms such as Metatrader or cTrader to their clients. Few brokers like Dukascopy have an in-house platform.

- Inactivity Fee: Some brokers will deduct money from your account balance if you do not perform any trades in a given time frame, such as 3 months. So, keep that in mind.

Best Forex Brokers

| Rank | Name | Best For | Min. Deposit | Website |

|---|---|---|---|---|

| 1. | HFM | Customized Trading, extensive tools | $5 | hfm.com |

| 2. | Exness | Beginners, trading app | $10 | exness.com |

| 3. | Dukascopy | Professionals, liquidity, overall | $100 | dukascopy.com |

| 4. | IB | US traders, tight spreads | N/A | interactivebrokers.com |

| 5. | eToro | Copy trading, beginners | $100 | etoro.com |

| 6. | Pepperstone | Advanced traders, $0 minimum | N/A | pepperstone.com |

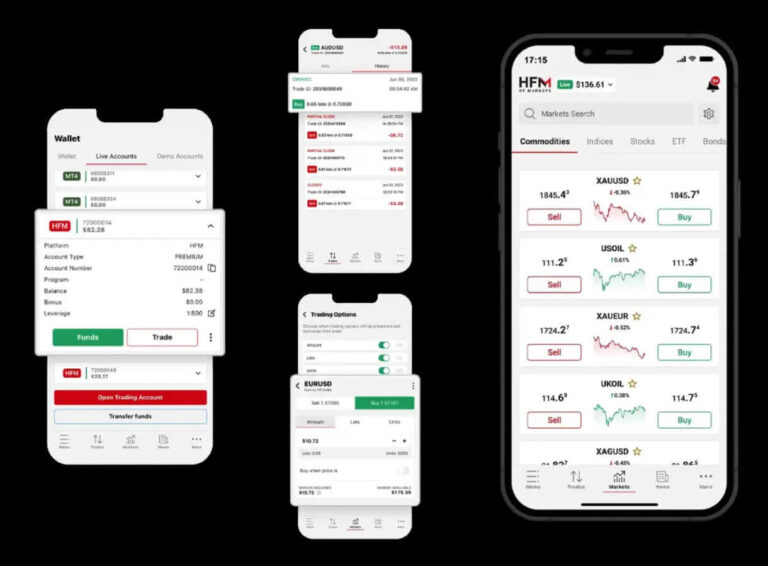

1. HFM

Highlights: Customized Trading, extensive tools

If you need a broker that provides lots of market research information for its clients, then HFM might be for you. Offering over 60 currency pairs and hundreds of stocks, indices, bonds, cryptos, options, and commodities, the platform is one of the most popular.

From educational tools such as webinars, ebooks, and video tutorials to articles, Forex calculator, signals, and social trading, HFM features everything for both beginners and advanced traders. The system uses Metatrader 4 and 5 for transactions, as well as the HFM app for mobile.

TickMill also offers a $50 no deposit account. All you have to do is register a new account with the platform and you get a $50 deposit that you can trade with and withdraw your earnings. This comes with conditions though.

Features:

- Lots of helpful tools

- up to 20% deposit bonus

- Works with Metatrader 4 & 5

Forex Pairs: 60+ and over 700 total instruments

Minimum Deposit: $5

Trading Platforms: MetaTrader 4 & 5, HFM Platform

Regulator(s): FCA, CySEC

2. Exness

Highlights: Low minimum deposit, user friendly

With over 800,000 active traders and licenses from multiple regulatory authorities, Exness is a top broker that is especially suited for beginners and experienced traders alike. It offers MT4 and MT5 trading platforms, as well as the Exness app, which combines account management with impressive trading features.

In addition to Forex, Exness offers trading in commodities, stocks, indices, and crypto instruments. Deposits and withdrawals are a breeze, with the company regulated in various regulations, including the UK’s FCA and Cypriot CySEC.

Exness further offers social trading accounts for those skilled enough to provide signal services and portfolio management accounts for professional portfolio managers.

Features:

- A low $10 minimum deposit

- Impressive mobile app

- Lets you trade hundreds of instruments

- Easy and user-friendly account management

Forex Pairs: 52 and 277 total instruments

Minimum Deposit: $10

Trading Platforms: Mt4, Mt5, and Exness app

Regulator(s): FSA, FSC, CySEC, FSCA, CBCS

3. Dukascopy Bank

Highlights: Actual bank with deposit protection, flexible, deep liquidity

Dukascopy is a Swiss bank that offers Forex trading to all levels of traders. It is regulated by FINMA, the Swiss financial authority with guarantees for your deposits up to about $100,000.

You can trade Forex, options, CFDs, stocks, and more on the platform. The rules are the same for all trader levels and spreads can go as thin as 0.1 pips during European session and 0.2 on average. Dukascopy also offers deep liquidity and flexibility that allows you to trade anything from 0.1 lot to as much as $200 million in notional volume with a single click.

Trading platforms include Jforex, Dukascopy’s sleek in-house platform, a web platform, iOS and Android apps, as well as MetaTrader 4 and 5. You can also get access to the JForex API or a FIX API, as well as Dukascopy’s Visual Jforex strategy builder for non-programmers.

The bank further offers a ton of market analysis tools and reports to keep you up to date, a PAMM system for wealth management, and traditional banking services–because it is a real bank.

Features:

- Very tight spreads with attractive commissions

- Deep liquidity broker for small and big accounts

- Wide range of instruments to trade

- Supports Metatrader 4 & 5

Forex Pairs: 60+, CFDs, Options, Crypto, Stocks

Minimum Deposit: $100

Trading Platforms: JForex, Mt4, Mt5, iOS and Android apps, web

Regulator(s): Swiss FINMA

4. Interactive Brokers

Highlights: US-based, low-margin requirements

The United States tightened its rules regarding Forex brokers and similar services, heavily reducing the maximum allowed leverage for U.S. traders. So, traders looking for a top U.S-domiciled broker can consider Interactive Brokers or IB.

Interactive Brokers offers low margin requirements, access to global markets, free news and research information, and lots of free trading tools, including 8 trading platforms for web, mobile, and desktops.

You should note, however, that Interactive Brokers is better suited for advanced traders and money managers who will value its flexibility and numerous options that can otherwise, overwhelm a beginner.

Features:

- US-based brokerage service

- Ideal for experienced and professional traders

- Competitively low margin rates

- Pays you interest on your cash balance

Forex Pairs: 100+, Options, Stocks, mutual funds, bonds

Minimum Deposit: N/A

Trading Platforms: 8 proprietary platforms

Regulator(s): SEC

5. eToro

Highlights: Huge community, copy trading, beginner-friendly

eToro is a massive Forex, stocks, crypto, and indices trading platform with millions of users from over 100 countries and that makes it easy for traders to interact with one another.

The eToro social trading system operates just like a social network for traders and investors. People interact, share ideas about markets and assets, and trade in groups.

There is also the CopyTrader feature that lets you copy experienced traders automatically and earn without being a professional. Each trader’s profile features his statistics and you can find lots of successful professionals on the platform.

eToro is regulated by the UK’s FCA, the Australian ASIC, cypriot CySEC, US FINRA, and more. The initial deposit is at least $100, but subsequent deposits can be as low as $1.

Features:

- Largest social trading platform

- Offers Forex, stocks, cryptos, and more

- Over 30 million users

- Huge selection of tradable assets

Forex Pairs: 40+ and 6,000+ total instruments

Minimum Deposit: $100

Trading Platforms: Mobile and web

Regulator(s): FCA, CySEC, ASIC, SEC, DNB

6. Pepperstone

Highlights: Advanced features, multiple platforms

Novice and experienced traders alike who want to test the most popular trading platforms will love Pepperstone, as it allows you to trade from either Metatrader 4, Metatrader 5, cTrader, TradingView, and their proprietary Pepperstone platform.

While Metatrader 4 and 5 remain the most popular trading platforms in the world, cTrader is popular with algorithmic traders and developers, while TradingView is the most popular web-based trading solution.

Each of these platforms has its strengths and weaknesses. So, as a Pepperstone user, you can easily and seamlessly discover what’s best for you.

Features:

- Free choice of popular trading platforms

- Competitively tight spreads

- In-house software with advanced features

- Regulated in multiple jurisdictions

Forex Pairs: 90+ Forex and1200+ total CFD instruments

Minimum Deposit: N/A

Trading Platforms: Metatrader4 & 5, cTrader, Pepperstone, TradingView

Regulator(s): FCA, ASIC, BaFin, CySEC,

Frequently Asked Questions

Here are some of the most frequently asked questions about Forex brokers.

Q: Can I make big money trading the Forex markets?

A: Yes, you can, but only if you trade with a profitable strategy.

Q: What are dealing desk brokers?

A: These are brokers that take the other side of your trade. In other words, they trade against you. If you want to buy a pair, they sell it to you and if you want to sell the pair, they will buy it from you. Dealing desk brokers work off the premise that most retail traders lose money. They are the opposite of Non-dealing desk brokers.

Q: What does day trading mean?

A: Day trading simply means that the trader will open and close positions within the same day, and that also means that all opened positions are closed before market close each day.

Q: How can I become a profitable Forex trader?

A: You can become a profitable Forex trader by learning or personally developing a profitable strategy and then trading with it.

Q: What is the best Forex trading software?

A: It is difficult to say, because different traders have different trading needs. However, Metatrader is the most widely used Forex trading software and is available in versions 4 and 5.

Conclusion

We have come to the end of this review of the best Forex brokers and you have seen what they have to offer that makes them unique and popular. You have also seen which companies are best for certain trader types.

Now is your turn to make a choice based on your needs.