How To Open And Use A Cent Trading Account

Have you heard about cent accounts and how they can aid your journey as a beginner in the trading world? Here’s a quick guide to opening and using them.

A cent trading account allows you to make and manage trades in cents, rather than in full dollars. This reduces your risk exposure while ensuring real participation in the market.

cent accounts run on nano lots–1/100th of a standard account. So, whereas each pip in a standard lot has an average value of $10, a pip in a cent account has an average value of $0.10.

Furthermore, since you can trade 0.01 lot on a standard account to get an average pip price of $0.10, you can trade the same 0.01 lot on a cent account for an average pip price of $0.001.

cent accounts allow you to trade the markets with minimal financial exposure, while everything else remains real. This article shows you how.

Who Needs A Cent Account?

It is very easy to lose large sums of money in trading the financial markets–especially when you don’t know what you are doing. Almost every new trader will blow one or more accounts before becoming a break-even or profitable trader.

The initial solution to avoiding this loss was paper-trading; also called demo accounts. Yet, while demo accounts offer risk-free trading environments, they fail to provide the real feelings and emotional engagements associated with real-life trading. Therefore, many new traders tended to disregard paper trading in general and attempted trading with 0.01 lots.

Trading with 0.01 lots, on the other hand, means that a 15-pip move against you will result in an average loss of $1.50. This amount may be insignificant to some beginners, but it is a lot for many others. With a cent account, on the other hand, the same 15-pip loss could have amounted to just $0.015 or 1.5 cents.

If you are a new trader, therefore, and you want to practice live trading with real money, but with limited risk exposure, then a cent account is probably the best solution for you.

Benefits Of A Cent Account

cent accounts are popular with new traders because of the many benefits they offer. These include lower risk, flexible sizing, and lower deposit amounts, among others. Here is a closer look at each of their many benefits.

- Lower Risk: Market prices move in percentage points (or PIPS for short), which represent a fraction of the instrument being traded. The beauty of analyzing markets in pips, rather than in real monetary value is the ability to lower or increase your risk, which in turn, lowers and increases your potential profit, from the same market movement–measured in pips.

For instance, trading 1 standard lot on a standard account, you risk about $100 for each 10-pip move against you on the EUR/USD Forex pair. You could reduce this risk by trading just 0.01 of a standard lot and thereby risk only $1 for every 10-pip move against you. A cent account further lowers this risk to $1 for a 10-pip move using a standard cent lot, up to as little as a 1 cent ($0.01) maximum risk for the same 10-pip move against you. - Real Practice Experience: While the lower monetary risk of running a cent account shields you from losing too much money early on in your trading career, it still blesses you with all the hard lessons that the market has to teach you. In other words, a cent account enables you to get a $20,000 education for about $200 or less.

Unlike a demo account where you stand to lose nothing if you have a bad trade, you will lose real money when trading on a cent account, although the loss will be much less than it would have been on a standard account. However, the pain of a losing trade remains real with cent accounts, pushing you to improve your skills and reduce your losses over time. - Flexible Sizing: cent accounts also allow flexible sizing of your trades, so that you can make the best of your capital. For brokers who offer the MetaTrader 4 and 5 platforms, you can easily vary your trade volume from as little as 0.01 lots to 100 or 200 lots, depending on the broker.

Lot sizing is a helpful strategy when trying to grow an account. You can calculate the ideal lot size for each trade using your stop-loss distance and your trading account’s balance. This way, you can slowly grow your account to trade larger and larger volumes. - Lower Minimum Deposits: Another major benefit of cent accounts is their lower minimum deposit amounts. Unlike standard accounts that may require hundreds of dollars to open and operate, cent trading accounts can do well on just a few dollars.

In fact, many brokers that offer cent account services do not have a minimum deposit amount or simply state a $0 minimum because even a $1 deposit can go a long way on a cent account. - Strategy Testing: The core of trading is the trading strategy. If you have a good strategy that can consistently generate more profits than losses for you, then you have a winner. Otherwise, you will first need to learn, buy, or develop a profitable trading strategy.

Whichever way you acquire your strategy though, you will need to test it out. Maybe you start first using a simulator, then on a demo account, and finally on a live account, using as little investment as possible. Hence, cent accounts are additionally attractive to those who desire to confirm the profitability of a trading strategy under live conditions, before finally allocating more money to it.

How to Open A Cent Account

Opening a cent account is as easy as opening any other type of trading account, so long as your broker of choice supports cent accounts. Otherwise, you will have to choose another broker that supports the cents account. We recommend Exness.

For most brokers, all you have to do if you already have an account with them is to log into your user area, click on “My Accounts” and find something like “Create a new Account”. The option to create a cent account (if supported) should be there.

If, on the other hand, you don’t already have an account with the broker, then you must register with them first. As each broker is different, you just need to follow their prompt here to complete your registration.

How to Use A Cent Account

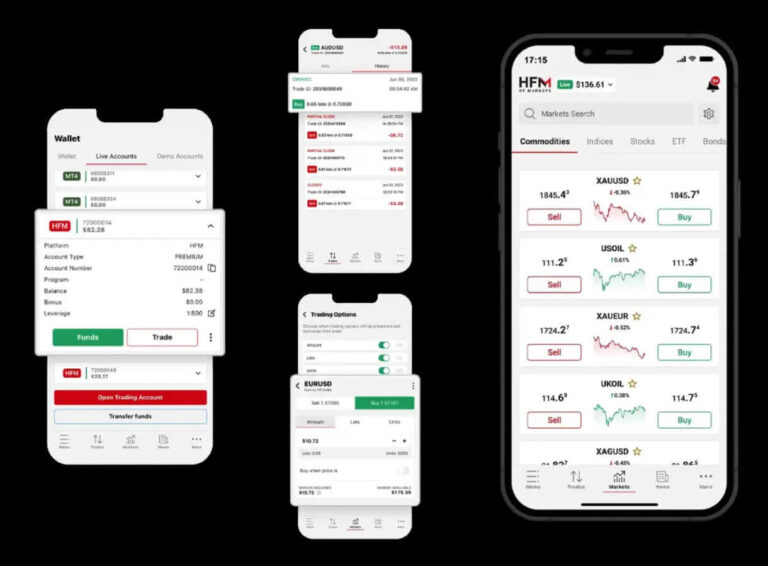

Using your new cent account is equally as easy as using any other account type. If your broker offers the MetaTrader 4 and 5 platforms, then all you have to do is copy your login credentials from the user area of your broker’s website, then log into your MetaTrader with those credentials, and you are good to go.

Keep in mind that you have to fund your cent account, just as with any other trading account. However, unlike other account types, your cent account balance will appear in cents (with one cent equal to $0.01). Aside from this display in cents, everything else is the same between trading a dollar-based and a cent-based account.

Frequently Asked Questions

The following are some of the most frequently asked questions concerning cent trading accounts.

Q: Who should use a cent account?

A: Cent accounts are ideal for beginners who want to transition from trading demo accounts to real accounts. They offer a very limited risk exposure to the markets while maintaining real market experiences with real wins and losses.

Q: Which instruments can I trade on a cent account?

A: The instruments that you can trade on a cent account vary depending on your broker. Most brokers, however, offer Forex and commodities trading on cent accounts.

Q: Do cent accounts have restrictions?

A: Yes, from their design, cent accounts are restricted on the upper side. That is the maximum number of orders/lots that you can open at a time. This makes sense though, because it’s easier to switch to a standard account and trade larger volumes than to try and trade larger volumes with a cent account.

Q: What is the minimum deposit to open a cent account?

A: There is no universal minimum deposit for opening a cent account, so it depends on the broker. Some brokers require $10 for all new customers, others require $100, while some will even accept $1.

Q: Can I open and use multiple cent accounts?

A: Yes, it is possible to open and use multiple cent accounts on your broker’s platform, so long as the broker supports this. Many brokers allow you to open many types of trading accounts once you have fully registered with them and are verified.

Conclusion

We have reached the end of this quick guide on how to open and use a cent trading account and you have seen all the benefits of a cent account and learned how to open and run one.

The final decision on whether or not you need a cent account lies with you though. But if you are still undecided or need more information, then check out the Exness cent account offer.