Complete Guide to Grid Trading on Binance Futures

Heard about Grid Trading on Binance, but not sure what it is? This guide shows you what it's all about and how to profit from the system.

Grid trading is a simple but effective method of automated trading. You can use grids to trade everything from stocks to currencies and crypto contracts.

Binance offers a grid trading robot on its platform, which makes it easy for users to automate trades. But if you are not familiar with the system and how to profit from it, then this guide is for you.

The grid trading technique is one of the simplest automation strategies. So, this makes it easy for both beginners and seasoned traders alike to understand and use. This post shows you everything you need to know.

Tips on Binance Futures Grid Trading

Before you jump in, here are a few tips and tricks to keep in mind.

- The Binance grid trading bot is designed only for trading ranges.

- You have to develop an eye for spotting ranges to profit from it.

- There are two setup modes; automatic and manual.

- You can also copy the automatic settings into the manual mode and tweak them.

- A wide range of settings lets you tailor the system to your needs.

- This guide is for Binance Futures, but a bot is also available for spot trading.

- Trading always carries a risk, so make sure you understand what you are doing.

What is Grid Trading?

Grid trading is a simple, yet effective method of trading the financial markets. It lets you set pre-determined price levels at which your trading platform or robot makes trades for you.

The goal of grid trading is to automate the already tried and tested trading methods of trend following and range trading.

Range trading involves buying the lows and selling the peaks of a ranging market. Ranging markets tend to move sideways while oscillating between high and low price levels. With some practice, these levels are easy to spot. And this makes for a good trading strategy.

But while ranges are easy to spot and profitable to trade, a fully manual trader will have to sit in front of the computer and wait patiently. This wait can be time-consuming and boring, so a grid trading bot makes your job easier.

Trend following, on the other hand, only works when the market is moving in a defined direction – either decidedly up or down. However, the Binance grid trading bot is not for trend trading, so the rest of this guide will focus only on range trading.

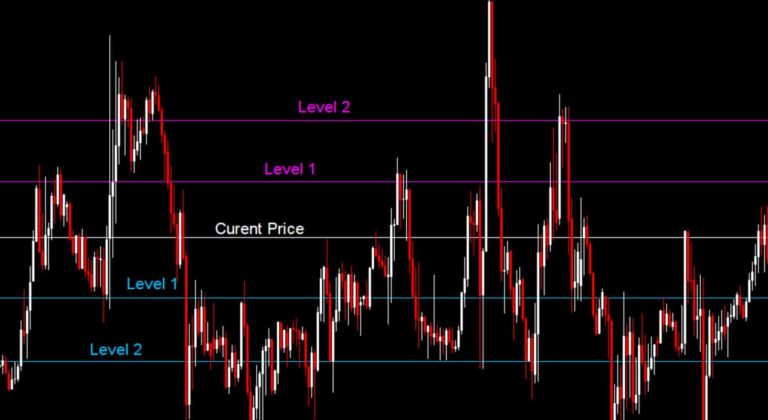

A grid is simply made up of horizontal lines above and below a set price. Each of these horizontal lines represents a market price and will act as a trigger for the trading robot.

During range trading, the horizontal price lines above the current market price will trigger sell orders, while the lines below the current price will trigger buy orders. The idea here is to buy at low and sell at high prices.

How Does Grid Trading Work?

Trading is the simultaneous exchange of assets between two parties. In financial trading, these assets can range from stocks to fiat, and cryptocurrencies. And a trading platform like Binance Futures makes these asset exchanges easy for all parties.

At certain times, however, traders will refuse a certain asset if they consider its price too high. Conversely, they will quickly buy up the same asset if they consider its price low.

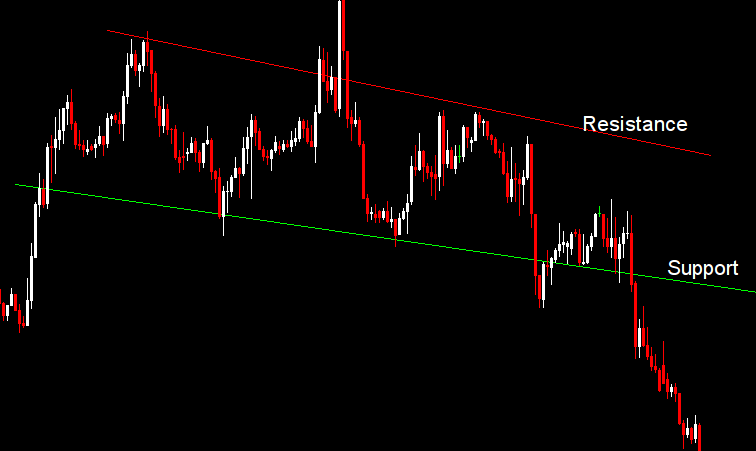

When this rejection and buy-ups happen over an extended period, then you have a ranging market. That is, prices go down to a support level, then rally back up to a resistance level. Then, they go back down to the support level, rally back up, and so on.

As a speculator or technical analyst that has noticed this pattern on the chart that you are studying, you will simply buy the asset when its price hits the support and sell when the price hits resistance. This is a sweet little strategy to make money from trading over and over again.

The grid trading robot makes this process even easier for you. Just set up the system with a few clicks, and you are free to do something else, while it automatically makes money for you.

What Are The Benefits of Grid Trading on Binance Futures?

Trading with the grid system on Binance Futures comes with so many advantages for both beginners and seasoned traders. If you are considering giving it a try, then here are some of the advantages you can expect.

- Easy to use robot trader.

- Perfect for beginners with its 1-click Auto parameters setup.

- Flexible manual setup option for expert traders.

- Full integration with your Binance portfolio.

- Binance is the largest crypto trading platform.

- The Binance platform is very liquid with great order executions.

- Low trading fees.

- Lots of helpful features and continuous improvement.

Why Crypto Beginners Need To Try Grid Trading

Those new to trading cryptos may want to check out grid trading for many reasons. And more especially when you don’t have the time to sit all day in front of your charts.

Unlike most other trading bots that use a myriad of algorithms that no one understands, the grid trading principle is easy to understand and implement. All you have to do is take a look at some price charts to pick a ranging instrument, and you are on.

The grid trading system’s simplicity makes it a perfect tool for beginners. And in addition to that, the Binance grid trading bot also comes with Auto Parameters, which include automatic presets that help you to easily set up your grid strategy.

How To Use Auto Parameters In Binance Grid Trading

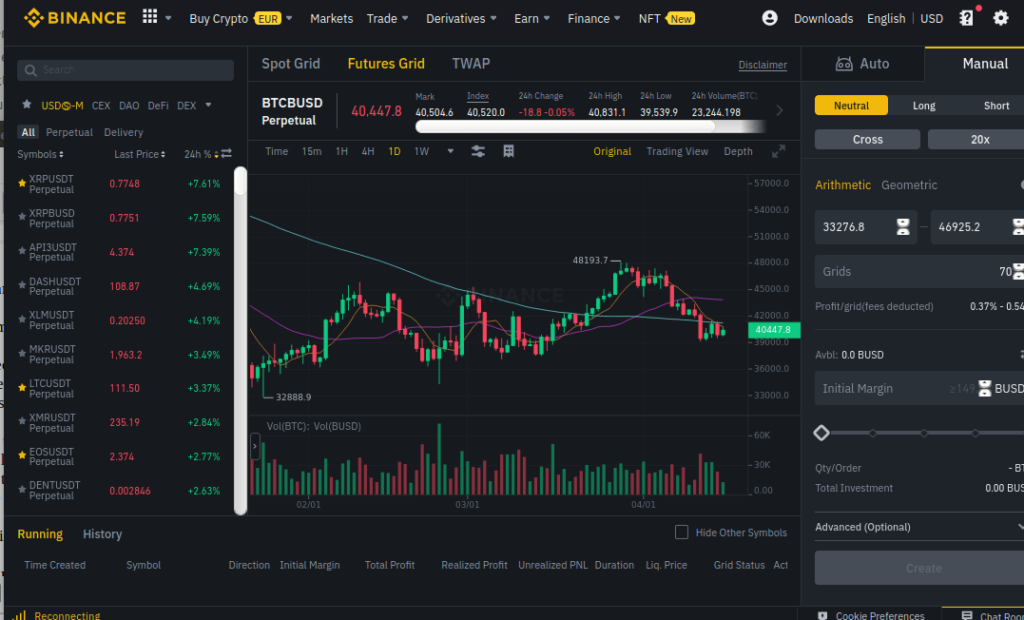

Those new to trading might find it beneficial to use the automatic mode, which Binance calls Auto Parameters. It quickly sets up a grid strategy for you, and you can learn as you go.

Using the Auto Parameters feature to set up your grid trader is very simple.

- First, you need to register or log into the system, if you haven’t already.

- Next, you need to tap or hover around the ‘Trade’ button in the top navigation bar. This pulls down a menu. Now click or tap on ‘Strategy Trading’ to get to the platform.

- Once loaded, the system presents you with the futures trading platform. And to the right, you have the Auto Parameters all set up and ready to go.

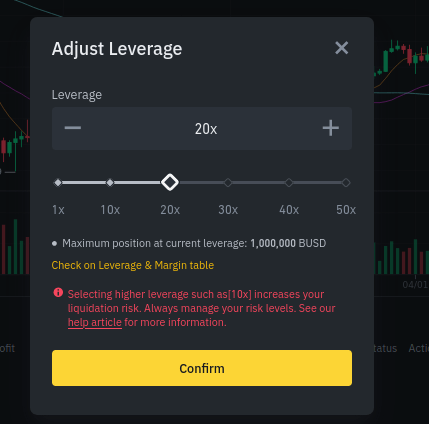

- Now, all you have to do is select your leverage preferences and the margin you want to allocate then hit the ‘Create button.

- The system will prompt you to confirm your order, and that’s it.

That’s how simple it is to use the grid trading bot on the Binance Futures platform.

Why Experienced Crypto Traders Need to Use Grid Trading

The Binance grid trading bot also works well for seasoned traders. If you are an experienced trader and are wondering if the platform is worth trying out, then here are some benefits you can expect:

- It frees your time so you can focus on other markets or activities.

- It makes you more productive.

- This bot is easy to set up and use.

- Its extensive controls give you all the flexibility you need.

How To Set Up A Custom Grid Trading Strategy From Scratch

If you would like to set up the grid on your own, then you should first understand the different parameters and their meanings. As this will help you to achieve your custom needs.

Following are the most important parameters for grid trading on the Binance Futures platform:

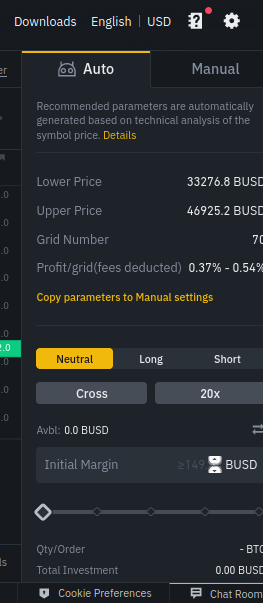

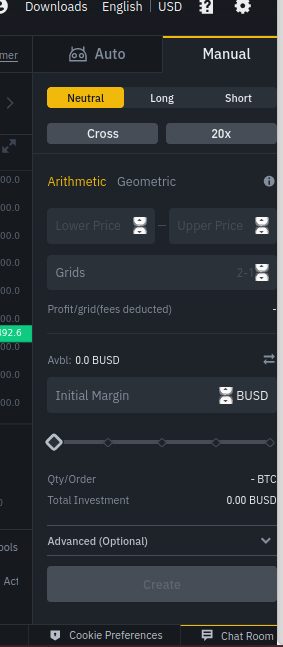

- Neutral vs Long/Short Grid – Binance grid trader allows you to either open a position immediately or start a neutral grid. If you immediately open a position, then your grid becomes a long or short grid, depending on your trade. If you open a neutral grid, then the system will activate once any of your price levels is breached.

- Arithmetic Vs Geometric – You can choose to have the grid levels separated by equal amounts of asset price (arithmetic) or by percentage relationships (geometric).

- Lower vs Upper Price – This is your lower and higher levels for the range. The support and resistance levels for that ranging market.

- Grid Number – This is the number of grid levels in the system. They will be equally divided between the lower and upper price settings.

- Cross Vs 20x (Isolated) – Here you have to select the type of margin you want. The cross margin lets you use the same capital as margin for all the positions you open on the platform. That is, different open positions or pairs can share in the margin. The 20x on the other hand is for an isolated margin. Here, you set a fixed margin for this pair that you are about to trade and the system will keep it separate from others.

- Stop Top Price Vs Stop Bottom Price – These are two prices that help to protect your account from excessive losses. The top price is the maximum level that once the market price rises above it, will trigger the grid to close. On the other hand, the bottom price is the lowest level that once the market price falls below it, will trigger the grid to close.

- Grid Trigger Price – This is the price level that triggers your grid once the market price rises above or falls below it. You only need this option when you do not wish to start your grid immediately.

Using the manual tab in setting up your grid trader with custom settings is also easy, once you know what all the parameters above mean.

- First, you need to register or log into the system, if you haven’t already.

- Next, you need to tap or hover around the ‘Trade’ button in the top navigation bar. This pulls down a menu. Now click or tap on ‘Strategy Trading’ to move to the platform.

- Once loaded, the system presents you with the futures trading platform. And to the right, you have the Auto Parameters all set up.

- You can either click on the ‘Copy parameters to manual setting’ link or click on the ‘Manual’ tab above to open the manual settings.

- Now it’s up to you to select market direction, leverage, grid spacing, number of grids, and margin.

- There is also an ‘Advanced’ options tab below these settings, where you can additionally set up the grid trigger prices, as well as order cancellation preferences.

- When you are done, just hit the Create button.

- The system will prompt you to confirm your order and that’s it.

Conclusion

You have seen the benefits of the grid bot for Binance Futures trading. And you will agree that it’s a well-designed system that includes all the other benefits of the Binance platform.

It is now up to you to see if you’ve got an eye for spotting ranging markets. Then all you have to do is click here and sign up today for grid trading on Binance.